Understanding the All-Weather Portfolio Strategy: Adapting to Market Volatility

Understanding the All-Weather Portfolio Strategy: Adapting to Market Volatility

Finding Stability in a Sea of Market Uncertainty

Imagine the stock market plummeting overnight, sending shockwaves through your investments. Fear grips many investors in such moments of volatility—but what if there were a strategy designed to ride out the storms of uncertainty? Enter the All-Weather Portfolio, a diversified investment strategy tailored to provide stability and growth in diverse market conditions. This approach isn’t just about surviving market swings; it’s about thriving through them. This beginner investment portfolio strategy is designed for long-term success.

Thank you for reading this post, don't forget to subscribe!Table of Contents:

- What is an All-Weather Portfolio?

- The Four Economic Climates

- Core Asset Allocation: Building a Diversified Investment Portfolio

- How the All-Weather Portfolio Addresses Market Volatility and Risk

- The Importance of Rebalancing Your Investment Portfolio

- Advantages of the All-Weather Portfolio

- Disadvantages of the All-Weather Portfolio

- Building Your Own All-Weather Portfolio: A Step-by-Step Guide

- Choosing the Right Assets for Your All-Weather Portfolio

What is an All-Weather Portfolio?

An All-Weather Portfolio is a diversified investment portfolio designed to perform well in any economic environment, whether markets are booming or in turmoil. The concept gained popularity through Ray Dalio, founder of Bridgewater Associates, although it traces its origins to Harry Browne, a financial advisor who emphasized diversification and risk management. This long-term investment portfolio strategy focuses on managing market volatility and portfolio risk.

The strategy rests on a simple yet powerful idea: no one can predict market movements perfectly, so building a portfolio that accounts for different economic climates is key to long-term success.

The Four Economic Climates:

To understand why the All-Weather Portfolio works, it’s essential to grasp the four economic climates identified by Harry Browne:

- Prosperity: Economic growth, rising corporate profits, and market expansion.

- Inflation: Rising prices, often accompanied by an increase in the cost of goods and services. Hedging against inflation is crucial for long-term investment success.

- Deflation: Falling prices, reduced consumer spending, and economic contraction.

- Recession: Declining GDP, high unemployment, and reduced corporate earnings.

Different asset classes perform uniquely under these conditions, making diversification crucial. For example, stocks may thrive during prosperity but struggle during recessions, while bonds and gold offer protection in deflationary or inflationary environments.

Core Asset Allocation: Building a Diversified Investment Portfolio

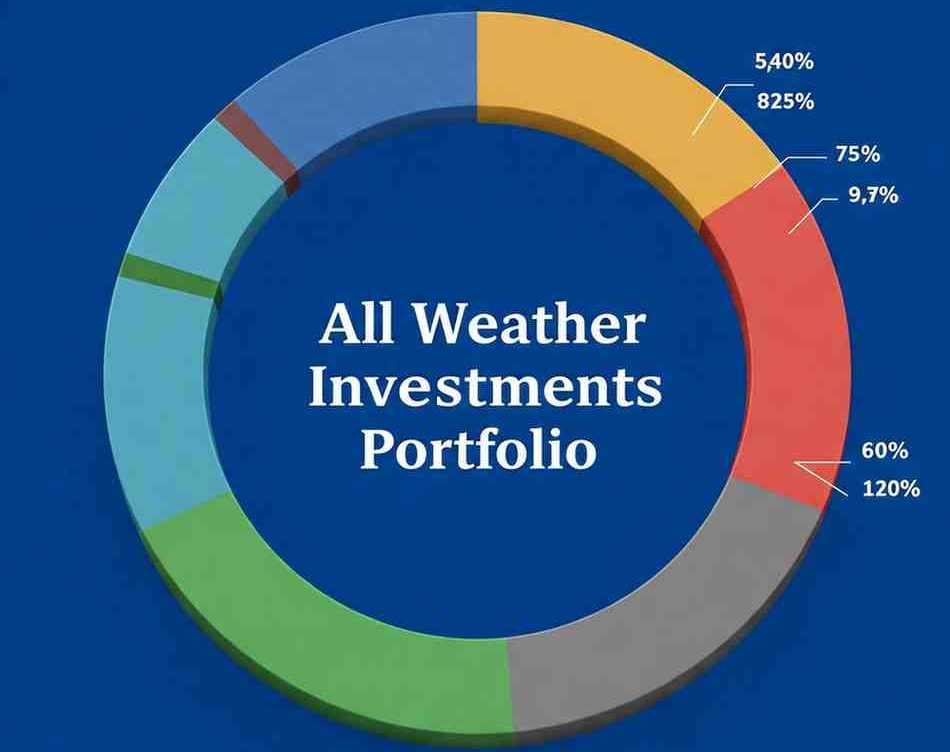

A typical All-Weather Portfolio diversifies across several key asset classes to hedge against various risks. Below is an example of how asset allocation may look:

- Stocks (30%): For growth during periods of prosperity. Examples: S&P 500 Index, emerging market stocks, large-cap stock ETFs.

- Long-term Bonds (40%): Provide stability during deflation and economic downturns. Examples: U.S. Treasury bonds, long-term bond ETFs.

- Commodities (15%): Protect against inflation by rising alongside prices of goods. Examples: broad commodity ETFs.

- Gold (15%): Acts as a hedge against inflation and currency devaluation. Gold can be included via gold ETFs or physical gold.

Each component serves a specific purpose, ensuring that the portfolio can adapt to changing conditions without drastic performance dips.

How the All-Weather Portfolio Addresses Market Volatility and Risk

The core strength of this strategy lies in diversification and risk management. By investing in assets with low or negative correlation, the portfolio reduces overall volatility. For instance, when stocks underperform during a recession, bonds often provide a counterbalance by delivering stable or positive returns. This helps to mitigate the impact of sudden market shocks and provides peace of mind to long-term investors. Understanding portfolio risk is central to this strategy.

The Importance of Rebalancing Your Investment Portfolio

Maintaining the target allocation is essential to the success of the All-Weather Portfolio. Over time, market movements can skew the initial allocation, so periodic rebalancing is required.

Key points on rebalancing:

- Frequency: Many investors rebalance annually, though some do it semi-annually or quarterly.

- Benefits: Rebalancing helps lock in profits from overperforming assets and reinvest them into underperforming ones, ensuring that the portfolio maintains its risk profile.

Advantages of the All-Weather Portfolio

- Reduced Volatility: Smooths out the impact of market swings by diversifying risks.

- Long-Term Growth Potential: Steady returns over time without the need for market timing.

- Simplicity and Ease of Management: Once set up, it requires minimal active intervention.

- Performance Across Economic Environments: Built to thrive in both growth and contraction cycles.

Disadvantages of the All-Weather Portfolio

- Potential for Lower Returns in Bull Markets: In strong bull markets, more aggressive portfolios may outperform.

- Discipline Required for Rebalancing: Maintaining the target allocation requires consistent effort.

- Complexity in Asset Selection: Choosing the right mix of assets can be challenging for beginners.

Building Your Own All-Weather Portfolio: A Step-by-Step Guide

- Identify your investment goals and risk tolerance.

- Allocate assets across different categories (stocks, bonds, gold, and commodities).

- Choose specific investments that match your allocation plan (e.g., ETFs, mutual funds).

- Regularly review and rebalance to stay aligned with your strategy.

Conclusion: A Strategy for Long-Term Financial Stability

The All-Weather Portfolio isn’t about achieving the highest returns in any given year—it’s about consistency, stability, and peace of mind. By diversifying across economic climates and maintaining discipline through rebalancing, investors can navigate market volatility with confidence.

Whether you’re a beginner seeking a simple, effective strategy or an experienced investor looking to refine your approach, the All-Weather Portfolio offers a roadmap for long-term success. Start building your diversified investment portfolio today and enjoy the journey toward financial stability.

Related Blogs:

How to Build an All-Weather Portfolio?

Diversifying Your Portfolio with India’s Steel Sector

The Role of Hospitality in a Diversified Portfolio: Why You Should Care

Renewable Energy Stocks: A Core Component of a Robust 2025 Portfolio

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.