ETF Investing in India: A Beginner’s Guide to Passive Wealth

ETF Investing in India: A Beginner’s Guide to Passive Wealth

Building wealth doesn’t always require aggressive stock-picking or daily trading. ETF investing in India is a smarter, low-cost, and passive way to grow your wealth steadily over time.

Thank you for reading this post, don't forget to subscribe!If you’re a beginner, this guide will walk you through what ETFs are, why they matter, how to invest via GWC India, and how ETFs are performing — complete with real charts to help you visualize your journey.

What is an ETF?

An Exchange Traded Fund (ETF) is an investment vehicle that pools money from investors and invests in a basket of assets — like stocks, bonds, or commodities.

It is designed to mirror an index like the Nifty 50 or the Sensex.

Simple Example:

If you invest in a Nifty 50 ETF, you’re automatically investing in India’s top 50 companies — without buying each stock separately.

Why Invest in ETFs in India?

✅ Low cost: Minimal management fees (low expense ratio)

✅ Diversification: One ETF = Exposure to dozens of companies

✅ Liquidity: Buy/sell anytime during market hours

✅ Transparency: Holdings disclosed daily

✅ Tax Efficiency: Favorable capital gains taxation for equity ETFs

How to Start ETF Investing with GWC India

Starting is simple and beginner-friendly with GWC India:

- Open a Demat & Trading Account

Complete your KYC process online via gwcindia.in. - Select the Right ETF

Choose from Nifty 50 ETFs, Gold ETFs, Sectoral ETFs, or International ETFs based on your goals. - Place Your Order

Invest directly through the GWC India trading platform. - Monitor & Rebalance

Review your ETF investments annually to stay on track.

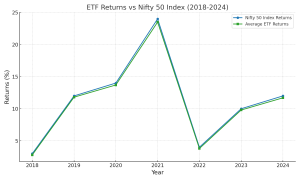

How ETFs Have Performed Over Time: A Visual Guide

ETFs have delivered returns almost matching major market indices like the Nifty 50, with minimal tracking error.

Here’s a chart comparing ETF returns vs Nifty 50 Index returns from 2018 to 2024:

Observation:

ETF returns closely follow the Nifty 50 — proving that ETFs are a reliable, low-maintenance way to invest in India’s growth story.

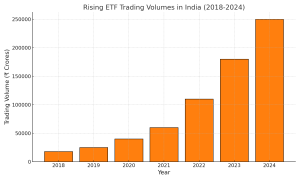

Rising Popularity of ETFs in India

The adoption of ETFs in India has skyrocketed, especially among young and first-time investors.

Take a look at the rising ETF trading volumes over the past few years:

Fun Fact:

In just six years, ETF trading volumes have grown by over 10x — a clear sign of increasing trust in passive investing!

Top ETF Categories for Indian Investors (2025)

Category |

Examples |

Goal |

| Equity ETFs | Nifty 50, Sensex ETFs | Wealth creation via stocks |

| Sectoral ETFs | Banking ETF, IT ETF | Sector-focused investing |

| Gold ETFs | SBI Gold ETF, GoldBees | Hedge against inflation |

| International ETFs | US Market ETFs | Global diversification |

| Debt ETFs | Bharat Bond ETF | Stable, low-risk returns |

Common Mistakes to Avoid in ETF Investing

❌ Investing without setting clear goals

❌ Ignoring expense ratios and tracking errors

❌ Chasing trending ETFs without research

❌ Frequent buying and selling (hurts returns)

❌ Not reviewing your portfolio yearly

ETF vs Mutual Fund: Which One’s Better?

| Factor | ETF (via GWC India) | Mutual Fund |

| Cost | Very low | Higher expense ratio |

| Trading Flexibility | Anytime during market hours | Only once daily at NAV |

| Transparency | Daily disclosure | Monthly/quarterly disclosure |

| Tax Efficiency | High for equity ETFs | Similar for equity MFs |

If you value control, transparency, and low cost, ETFs are your best bet!

Why ETFs Are Ideal for Passive Wealth Creation

- No need for active stock selection

- Minimal fees = More money for you

- Easy SIP-style investing possible

- Good for retirement, education, or general wealth-building

- Stress-free compared to direct equity investing

The Future of ETF Investing in India

🚀 ₹10 lakh crore AUM projected by 2027

🚀 Launch of new ETFs focusing on sectors like EVs, Green Energy, and Global Tech

🚀 Rising retail investor participation — more people than ever are discovering the power of ETFs!

Final Thoughts: Start Your ETF Journey Today with GWC India

ETF investing in India offers a golden opportunity to build wealth passively, without needing to watch the markets every day.

Thanks to easy-to-use platforms like GWC India, you can start your journey within minutes.

✅ Low cost

✅ Full transparency

✅ Access to India’s growth story

Don’t wait. Start your passive wealth creation journey today with GWC India!

FAQs About ETF Investing in India

Q1: Are ETFs good for beginners in India?

Yes, they offer low cost, diversification, and simplicity — ideal for new investors.

Q2: How do I buy ETFs through GWC India?

Open a free Demat and trading account on gwcindia.in and start buying ETFs easily.

Q3: What is the minimum amount to invest in ETFs?

As little as ₹100 to ₹500 depending on the ETF’s market price.

Q4: Are ETFs taxed in India?

Yes — 10% on long-term gains after one year, and 15% on short-term gains for equity ETFs.

Q5: Which ETFs should beginners start with?

Nifty 50 ETFs, Sensex ETFs, and Gold ETFs are excellent starting points.