Compounding Power: How Time Turns Small Investments Big

Compounding Power: How Time Turns Small Investments Big

Compounding is often called the “eighth wonder of the world,” and for good reason. It is the silent force that transforms small, consistent investments into substantial wealth over time. For investors, especially those just starting out, understanding compounding is not just useful—it’s essential.

Thank you for reading this post, don't forget to subscribe!

This blog explores how compounding works, why time is its most critical ingredient, and how you can leverage it to secure your financial future.

A Tale of Two Investors

Let’s start with a simple story.

Ravi starts investing ₹5,000 per month at age 25. He does this for just 10 years and then stops.

Priya, on the other hand, starts later—at age 35. She invests the same ₹5,000 per month until age 60, a full 25 years.

Who ends up with more wealth at age 60?

Despite investing for a shorter period, Ravi ends up with a corpus of ~₹1.58 crore, while Priya ends up with ~₹1.27 crore.

The difference? Time. Ravi gave his investments more years to grow. That’s the compounding edge in action.

What Is Compounding?

In simple terms, compounding is the process where your investment earns returns, and those returns start earning returns too.

Formula: A = P (1 + r/n)^(nt)

Where:

- A = Amount after time

- P = Principal amount

- r = Annual interest rate

- n = Number of compounding periods per year

- t = Number of years

The earlier and longer you invest, the more powerful compounding becomes.

Why Time Matters More Than Amount

Compounding rewards the patient. The sooner you start, the less you may need to invest overall.

Using our Ravi and Priya example, Ravi invested for only 10 years, but his early start gave him a longer runway for growth. This led to higher returns even though he stopped investing long before Priya.

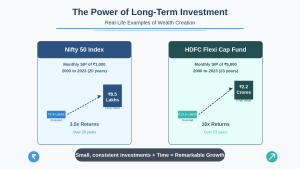

Real-Life Examples

- Nifty 50 Index: A monthly SIP of ₹1,000 from 2003 to 2023 (~20 years) would have grown to ~₹8.5 lakhs.

- HDFC Flexi Cap Fund: SIP of ₹5,000/month since 2000 would be worth over ₹2.2 crores today.

Even with modest investments, time delivers incredible growth.

The Psychology Behind Compounding

Compounding works best when you don’t interrupt it. But human behavior often gets in the way:

- Stopping SIPs during market crashes

- Withdrawing early for short-term needs

- Chasing high returns instead of staying consistent

“Time in the market beats timing the market.”

Staying invested and allowing money to grow undisturbed is how compounding shines.

How to Maximize the Power of Compounding

- Start Early: Even small amounts matter when started early.

- Stay Invested: Don’t pause SIPs during volatility.

- Reinvest Returns: Don’t withdraw dividends or gains.

- Increase Contributions: Use top-up SIPs to boost impact over time.

- Be Patient: The biggest gains often come in the later years.

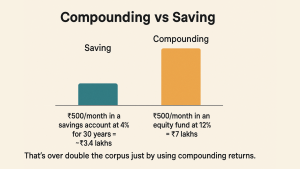

Compounding vs Saving

- ₹500/month in a savings account at 4% for 30 years = ~₹3.4 lakhs

- ₹500/month in an equity fund at 12% = ~₹7 lakhs

That’s over double the corpus just by using compounding returns.

Conclusion

Compounding is the most powerful tool in an investor’s arsenal. It rewards patience, consistency, and discipline more than sheer capital. No matter your age or income, the sooner you begin, the more you benefit.

Start small. Stay the course. Let time do the heavy lifting.

🚀Start Compounding Today

At Goodwill Wealth Management, we help investors craft SIP strategies tailored to their goals and timelines.

Contact us to begin your journey of financial growth through the magic of compounding.