Gold ETFs in India: A Smart Hedge Against Inflation?

Gold ETFs in India: A Smart Hedge Against Inflation?

Gold has long been seen as a symbol of wealth and security in Indian households. But in today’s digital-first investing world, you no longer need to buy physical gold to benefit from its value.

Thank you for reading this post, don't forget to subscribe!Gold ETFs (Exchange-Traded Funds) offer a smarter, more efficient way to invest in gold—without lockers, making charges, or purity concerns.

More importantly, gold has historically been a reliable hedge against inflation and market volatility. Let’s explore how Gold ETFs work and whether they deserve a place in your portfolio.

What Are Gold ETFs?

A Gold ETF is a mutual fund that invests in physical gold of 99.5% purity. Each unit of a Gold ETF typically represents 1 gram of gold, and these units are traded on stock exchanges like any stock.

✅ Backed by actual gold stored securely

✅ Price mirrors domestic gold prices

✅ Held in your demat account

📌 Think of it as buying gold digitally—with zero hassle.

Why Gold ETFs Are Popular in India

✅ Transparency

You can track prices in real-time, just like stocks.

✅ Liquidity

Buy or sell anytime during market hours. No need to visit a jeweller.

✅ Cost-Efficient

No making charges, no GST on units (only 0.5–1% expense ratio).

✅ Purity Guaranteed

Backed by 99.5% pure gold, unlike physical gold which may vary in quality.

✅ Ideal for Diversification

Gold often performs well during market downturns, helping reduce portfolio volatility.

Gold as a Hedge Against Inflation

When inflation rises, the value of currency falls—but gold tends to rise. That’s why investors flock to gold during economic uncertainty.

💡 From 2000 to 2020, gold delivered an average return of ~10–12% per annum—often beating inflation and even equity returns during crises like 2008 and 2020.

Real-Life Example: Priya’s Smart Move

Priya, a 35-year-old working professional, wants to hedge against inflation and market risk.

- She invests ₹1 lakh in a Gold ETF through her demat account.

- Over 5 years, gold prices rise due to inflation and global uncertainty.

- Her ETF value appreciates without worrying about storing physical gold or paying locker fees.

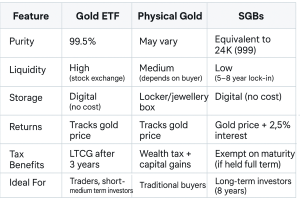

Gold ETFs vs Physical Gold vs Sovereign Gold Bonds (SGBs)

When Should You Invest in Gold ETFs?

💡 Consider Gold ETFs if You:

- Want to hedge against inflation

- Need liquidity and flexibility

- Prefer holding gold digitally in demat form

- Don’t want to worry about theft or storage

✅ Use Gold ETFs to diversify your portfolio—especially during uncertain markets, high inflation, or geopolitical stress.

Things to Watch Out For

🔸 Demat Required: You need a trading & demat account to invest.

🔸 No Extra Interest: Unlike SGBs, Gold ETFs don’t offer interest income.

🔸 Tracking Error: Returns may slightly lag physical gold due to fund expenses.

🔸 Short-Term Taxation: Gains held <3 years taxed as per your slab.

Conclusion

Gold ETFs offer the best of both worlds—the safety of gold and the convenience of digital investing. They’re liquid, cost-effective, and an excellent tool to protect your portfolio from inflation and market shocks.

While gold shouldn’t be your entire investment strategy, a 5–15% allocation to Gold ETFs can add much-needed balance and security to your financial plan.

Ready to Hedge Smartly with Gold?

At Goodwill Wealth Management, we help investors build resilient portfolios—including the right exposure to gold via ETFs or SGBs—based on your goals and risk profile.

Reach out to us to understand how gold can protect your wealth in any economic environment.