Asset Allocation: The Key to a Balanced Investment Portfolio

Asset Allocation: The Key to a Balanced Investment Portfolio

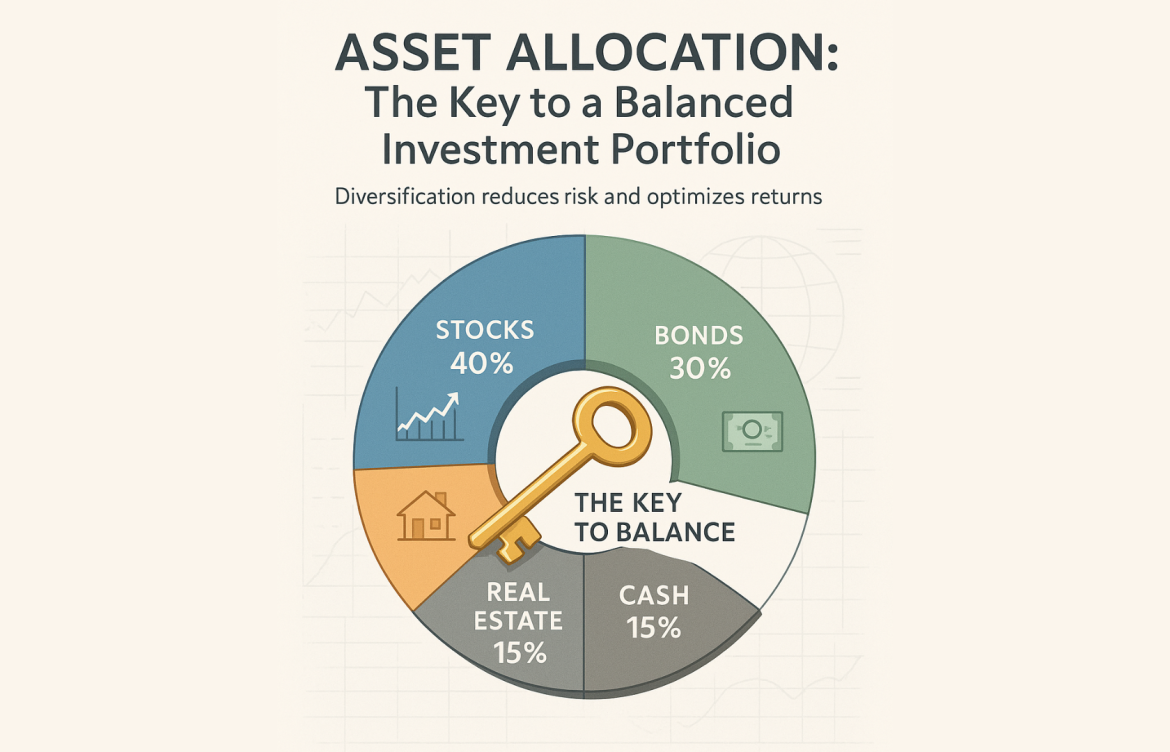

Every investor wants good returns—but the smartest investors focus not just on returns, but on managing risk while achieving those returns. That’s where asset allocation comes in. Asset allocation is the strategy of distributing your investments across different asset classes (equity, debt, gold, real estate, etc.) based on your risk appetite, goals, and time horizon. It’s the foundation of long-term wealth creation, helping you stay invested through market cycles and preventing overexposure to any one type of asset.

Thank you for reading this post, don't forget to subscribe!Let’s explore how asset allocation works, why it matters, and how to get started.

What Is Asset Allocation?

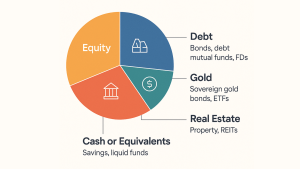

Asset allocation is the process of dividing your investment portfolio among different asset categories such as:

- Equity: Stocks, equity mutual funds

- Debt: Bonds, debt mutual funds, FDs

- Gold: Sovereign gold bonds, ETFs

- Real Estate: Property, REITs

- Cash or Equivalents: Savings, liquid funds

The idea is to balance risk and reward by diversifying your capital across assets that perform differently under varying economic conditions.

Why Asset Allocation Matters

- Reduces Portfolio Volatility: Different assets respond differently to market conditions. When equities fall, bonds or gold may rise, cushioning your losses.

- Maximizes Risk-Adjusted Returns: Instead of chasing the highest return, you focus on consistent returns with manageable risk.

- Supports Goal-Based Investing: Each financial goal can have its own asset mix based on the time frame and risk profile.

- Improves Discipline: A structured asset allocation strategy keeps you from making emotional, reactive investment decisions.

Types of Asset Allocation Strategies

- Strategic Asset Allocation

This is a long-term, fixed-ratio approach. For example, 60% equity, 30% debt, 10% gold. You review it annually but keep the structure mostly intact.

- Tactical Asset Allocation

This involves short-term shifts based on market outlook. For instance, reducing equity exposure in overheated markets and increasing debt.

- Dynamic Asset Allocation

Often used in Balanced Advantage Funds (BAFs). Fund managers adjust equity and debt exposure based on market valuation models.

How to Build Your Asset Allocation Strategy

Step 1: Assess Risk Profile

Use a risk profiler or speak to an advisor to understand whether you’re conservative, moderate, or aggressive.

Step 2: Define Your Financial Goals

- Short-term (<3 years): Prioritize capital safety (debt, liquid funds)

- Medium-term (3–5 years): Balanced mix (hybrid funds, debt + equity)

- Long-term (>5 years): More equity for higher growth

Step 3: Choose Asset Classes Accordingly

- Equity: High risk, high reward

- Debt: Stable, low-risk income

- Gold: Hedge against inflation and uncertainty

- Cash: For emergencies and liquidity

Step 4: Review & Rebalance Periodically

Market movements can skew your original allocation. Rebalancing—selling overperforming assets and buying underperforming ones—restores balance.

Example: If equity grows from 60% to 75% of your portfolio, sell some equity and buy more debt or gold to restore your mix.

Real-Life Example: 35-Year-Old Professional

Vikram, a salaried 35-year-old with moderate risk tolerance and a 15-year horizon for retirement, could follow:

- 60% Equity (index funds + large/mid-cap funds)

- 30% Debt (short duration and corporate bond funds)

- 10% Gold (SGBs or gold ETFs)

He rebalances annually to stay on track and uses separate SIPs for each asset class.

What Happens Without Asset Allocation?

- Overexposure to one asset = greater risk (e.g., all-in on equity during a market crash)

- Under-diversified = lower returns (e.g., too much in FDs losing out to inflation)

- No liquidity = poor emergency readiness (e.g., all in property or locked funds)

Conclusion

Asset allocation is not a one-time decision—it’s an ongoing discipline that evolves with your life stage, goals, and market environment. By following a thoughtful asset allocation strategy, you can build a resilient portfolio that grows consistently while minimizing unnecessary risks.

Whether you’re just starting out or already investing, it’s never too late to reassess and rebalance.

Need Help With Your Asset Allocation?

At Goodwill Wealth Management, we help investors create customized asset allocation plans based on their risk profile, life goals, and market outlook.

Talk to our experts and create a balanced portfolio that works for you.