Index Funds vs Actively Managed Funds: Cost, Risk, and Returns

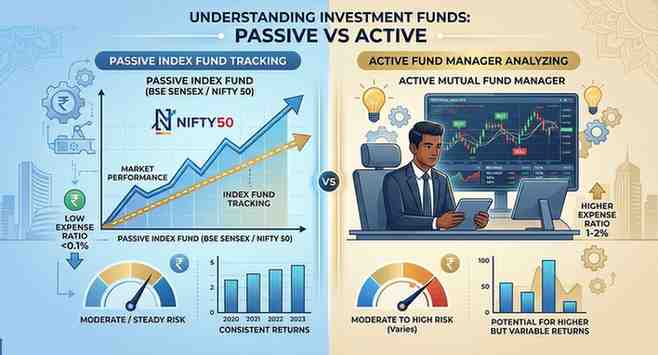

Index Funds vs Actively Managed Funds: Cost, Risk, and Returns As Indian investors gain greater access to low-cost investment products, the comparison between index funds vs active

Index Funds vs Actively Managed Funds: Cost, Risk, and Returns As Indian investors gain greater access to low-cost investment products, the comparison between index funds vs active

What Are the Key Lessons from Past Market Corrections in India That Investors Often Ignore? Market corrections are a normal and recurring feature of equity markets, often driven by

How Should Retail Investors Interpret Auditor Remarks and Emphasis of Matter Sections? Auditor remarks and Emphasis of Matter sections highlight financial risks, uncertainties, or

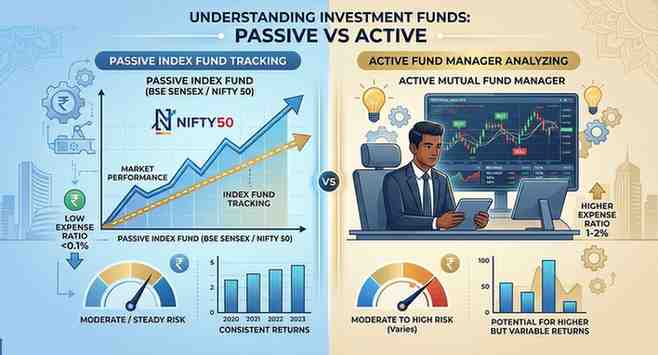

Active vs Passive Investing in India: Key Differences Explained In recent years, the debate around active vs passive investing India has moved from niche financial discussions into

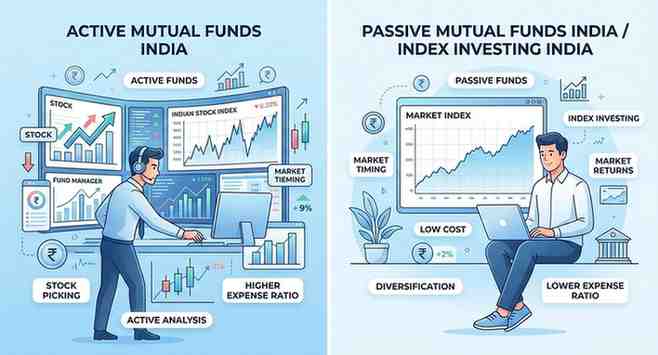

Why Do Some Indian Companies Consistently Miss Analyst Estimates? Companies consistently missing analyst estimates often face structural business challenges, weak forecasting disci

What Is Passive Investing? Index Funds and Long-Term Wealth Creation Passive investing has gained meaningful traction among Indian investors over the past decade. With growing awar

How Do Changes in Import Duties Affect Sector Profitability on Indian Stock Exchanges? Import duty changes directly affect company costs, pricing power, and competitiveness, influe

What Is Active Portfolio Management? Strategy, Benefits, and Risks Active portfolio management is an investment approach where fund managers actively buy, sell, and adjust securiti

What Is Cash Conversion Cycle and Why Is It a Red Flag Metric for Indian Investors? The Cash Conversion Cycle (CCC) measures how quickly an Indian company converts its investments

What Is an Inverse ETF and How Does It Work? As market participation deepens, Indian investors are becoming more aware of advanced exchange-traded products. One such instrument tha