Best Sectors for Value Investing During Economic Downturns

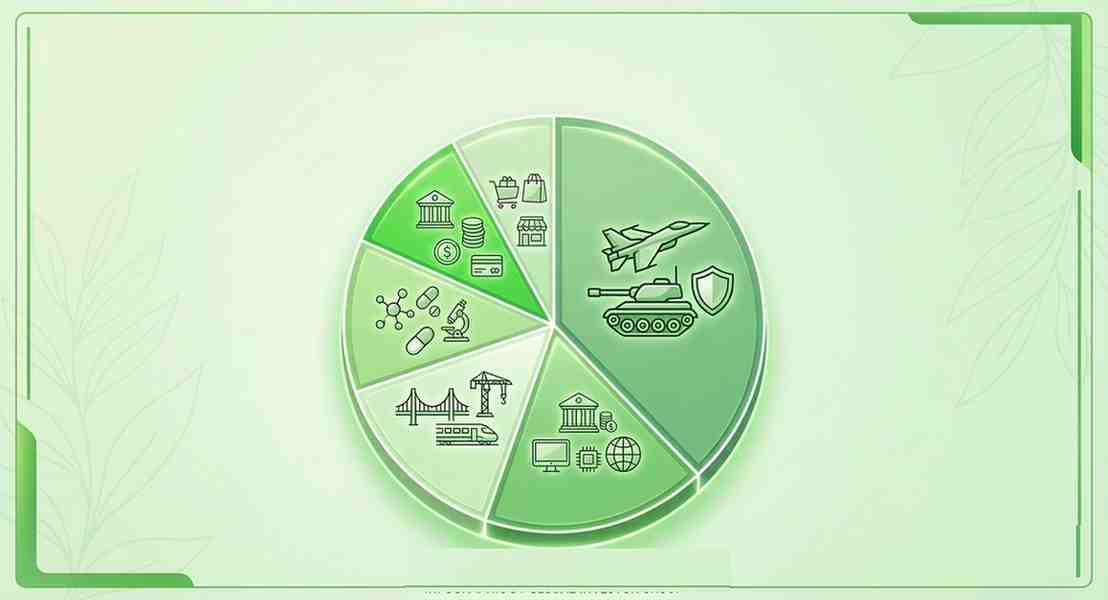

Best Sectors for Value Investing During Economic Downturns Economic cycles are a natural part of financial markets. Periods of rapid expansion are often followed by phases of slowd

Best Sectors for Value Investing During Economic Downturns Economic cycles are a natural part of financial markets. Periods of rapid expansion are often followed by phases of slowd

How to Analyze Fertilizer Stocks Before Investing Fertilizer companies occupy an important position in the agricultural value chain. In an economy like India, where agriculture con

Infrastructure vs Real Estate Stocks: Key Differences Investors exploring sectoral opportunities in India often compare infrastructure vs real estate stocks to understand which seg

Key Risks in Defence Stocks in India That Retail Investors Should Know Defence stocks in India can offer long-term growth potential due to government focus on indigenisation and mi

How Can Investors Identify Whether Indian Stocks Are Overvalued or Undervalued? Indian investors can identify whether stocks are overvalued or undervalued by comparing valuation ra

How Does Corporate Earnings Growth Affect Long-Term Stock Price Performance in India? Corporate earnings growth is one of the most important drivers of long-term stock price perfor

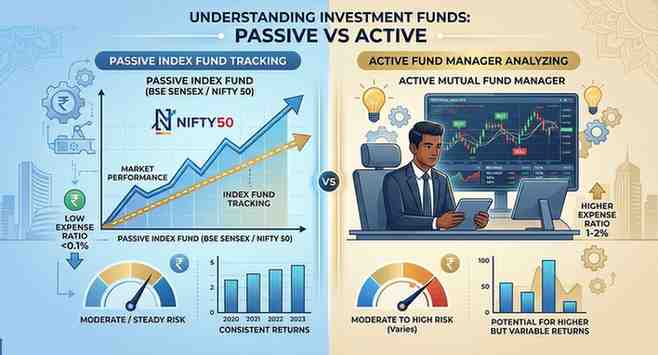

When Should Investors Choose Active Over Passive Investing? As passive investing gains wider acceptance among Indian investors, a practical question keeps surfacing: when should yo

Defence Stocks vs Other Sectors: How Do They Compare for Investors in India? Defence stocks in India differ from banking, IT, and infrastructure sectors in terms of demand drivers,

Key Risks of Investing in Infrastructure Stocks in India Infrastructure stocks in India can benefit from long-term government spending and economic growth, but they also carry mean

Index Funds vs Actively Managed Funds: Cost, Risk, and Returns As Indian investors gain greater access to low-cost investment products, the comparison between index funds vs active