Direct vs Regular Mutual Funds: Which Gives You Better Returns?

Direct vs Regular Mutual Funds: Which Gives You Better Returns?

Mutual funds are a go-to option for wealth creation. But when investing, you’ll often come across two options:

Direct Plan vs Regular Plan.

They both invest in the same portfolio, managed by the same fund manager—so what’s the difference?

The answer lies in returns, costs, and how you invest. Let’s break it down and help you choose the one that fits your needs best.

What’s the Difference Between Direct and Regular Plans?

✅ Direct Plan

- You invest directly with the mutual fund company (AMC)

- No distributor or intermediary involved

- Lower expense ratio (no commission)

- Higher returns over time

- Requires self-research or advisor consultation

🔁 Regular Plan

- You invest through a mutual fund distributor or advisor

- The AMC pays them a commission (included in the fund’s expense)

- Slightly lower returns due to higher expense ratio

- Suitable for investors who need guidance or handholding

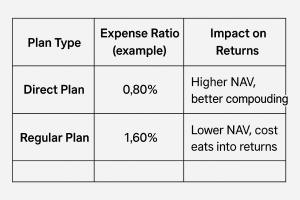

Expense Ratio Comparison: The Key Factor

📌 Pro Tip: Over 10–15 years, even a 0.5% difference can significantly affect your total wealth.

Real-Life Example

Investment: ₹10,000/month SIP for 15 years

Fund: Same equity mutual fund (Direct vs Regular)

Assumed Return (before expenses): 12% CAGR

Plan Type | Approx. Maturity Value | Difference |

Direct | ₹50.2 lakhs | |

Regular | ₹46.5 lakhs | ₹3.7 lakhs less |

That’s the power of lower expenses and compounding in a Direct Plan.

Which One Should You Choose?

Choose Direct Plan if:

- You’re comfortable doing your own research

- You use platforms like Coin, Groww, Kuvera, or the AMC website

- You want to maximize long-term returns

- You work with a fee-only advisor (instead of commission-based)

Choose Regular Plan if:

- You prefer expert help in selecting/reviewing funds

- You want someone to manage rebalancing and goal tracking

- You’re okay with paying a slightly higher cost for guidance

Can You Switch from Regular to Direct?

Yes!

You can easily switch to Direct Plans via:

- AMC website or app

- RTA platforms (like CAMS, KFintech)

- Online marketplaces that support Direct Plans

📌 Note: It may involve exit loads or capital gains tax if sold before 1 year (for equity funds).

Summary: Direct vs Regular

Feature | Direct Plan | Regular Plan |

Expense Ratio | Lower | Higher |

Returns | Higher | Lower |

Advisory Support | DIY / fee-based | Commission-based |

Best For | Informed investors | Beginners needing guidance |

Conclusion

Direct Plans offer better returns over the long term due to lower costs. But Regular Plans can add value if you need help navigating investments.

The best choice?

Depends on your confidence, knowledge, and willingness to manage your own money.

Need Help Making the Right Choice?

At Goodwill Wealth Management, we help you understand whether Direct or Regular suits your investment style—and make sure your portfolio aligns with your goals.

Talk to our experts and build your wealth with clarity and confidence.