Equity Investing 101: Building Long-Term Wealth Through Stocks

Equity Investing 101: Building Long-Term Wealth Through Stocks

In the evolving landscape of personal finance, one avenue consistently stands out as a long-term wealth generator: equity investing. With India’s growing economy, youthful population, and increasing retail investor participation, equity markets have become more accessible than ever. Still, many investors hesitate, often due to a lack of understanding or fear of risk.

Thank you for reading this post, don't forget to subscribe!This guide demystifies equity investing and lays out a roadmap for building sustainable, long-term wealth through the stock market.

What Is Equity Investing?

Equity investing involves buying ownership in companies through their publicly traded shares. These shares are bought and sold on stock exchanges such as the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

When you buy a share, you essentially become a part-owner of that company, entitled to a portion of its profits and a say (albeit small) in its operations.

Returns from equities come from two sources:

- Capital Appreciation: An increase in the stock price over

- Dividends: A share of the companys profits paid to

Why Choose Equities for Long-Term Wealth?

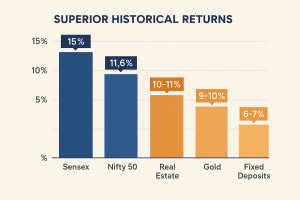

Superior Historical Returns

Over the last 30 years, Indian equities have outperformed most other traditional asset classes. For instance:

- The Nifty 50 index has delivered ~11.6% CAGR over the past 20.

- Sensex, since its inception in 1979, has grown from 100 to over 65,000, translating to a CAGR of over 15%.

Compare this with:

- Fixed Deposits: ~6-7% annual return (pre-tax)

- Gold: ~9-10% CAGR

- Real Estate: ~10-11% CAGR (location-dependent)

Power of Compounding

Equity investing leverages the exponential growth of compounding over time. An investment of 1 lakh in the Nifty 50 index 20 years ago would be worth over 6.7 lakhs today, assuming a ~12% annual return.

Compounding is the eighth wonder of the world. He who understands it, earns it; he who doesnt, pays it. Albert Einstein.

Inflation Beating Potential

Unlike FDs or savings accounts, which may barely outpace inflation, equities generate real (inflation-adjusted) returns, safeguarding and growing purchasing power.

Ownership in Growth

Buying equities allows investors to participate in India Inc.s growth storyfrom IT giants like Infosys and TCS to new-age tech and manufacturing companies under “Make in India.”

How to Start Investing in Equities

-

Open a Demat and Trading Account

Use SEBI-registered brokers to open your Demat and trading accounts.

-

Start with Index Funds or Blue Chip Stocks

For beginners, low-cost index funds (like Nifty 50 ETFs) or large-cap stocks provide a stable entry point.

-

Decide on Your Investment Style

- Active Investing: Picking and choosing individual

- Passive Investing: Investing through mutual funds or

-

Diversify Your Portfolio

Avoid overexposure to a single stock or sector. Spread investments across:

- Market caps: large, mid, and small-cap

- Sectors: banking, IT, FMCG, pharma,

-

Invest Regularly via SIPs

Use Systematic Investment Plans (SIPs) to invest a fixed amount monthly in mutual funds. SIPs help smooth market volatility and instill discipline.

Understanding the Risks

- Market Volatility: Prices fluctuate due to economic, political, or global

- Company-Specific Risks: Poor management, debt, or earnings

- Emotional Investing: Panic selling or greedy buying can lead to sub-optimal

The stock market is a device for transferring money from the impatient to the patient. Warren Buffett

Taxation on Equity Investments in India

- Short-Term Capital Gains (STCG): 15% on gains from shares sold within 12 months.

- Long-Term Capital Gains (LTCG): 10% on gains above 1 lakh for shares held over 12 months.

Dividends are taxed as per your income slab.

Tax-saving equity options include ELSS (Equity Linked Saving Schemes), which offer Section 80C deductions.

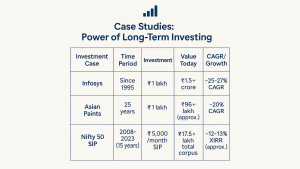

Case Studies and Examples

Infosys:

- If you had invested 1 lakh in Infosys in 1995, it would be worth over 1.5 crores today.

Asian Paints:

- Over the past 25 years, Asian Paints has delivered ~20% CAGR, making early investors multi-millionaires.

SIP in Nifty 50:

- Monthly 5,000 SIP in a Nifty index fund from 2008 to 2023 would have grown to over 17.5 lakhs.

Key Metrics to Analyze Stocks

- P/E Ratio (Price-to-Earnings)

- ROE (Return on Equity)

- Debt-to-Equity Ratio

- Earnings Growth

- Free Cash Flow

Conclusion

Equity investing is not a get-rich-quick schemeits a disciplined, long-term approach to wealth creation. With strong fundamentals, patience, and diversification, anyone can build a robust portfolio that outpaces inflation and meets life goals.

In a rapidly growing economy like India, starting your equity journey today could be one of the smartest financial decisions you ever make.

Start Your Equity Journey Today

At Goodwill Wealth Management, we help investors like you create customized equity portfolios aligned with your financial goals, risk appetite, and investment horizon.

[Contact Us](https://gwcindia.in/contact) to get started.