How to Choose the Right Mutual Fund for Your Financial Goals

How to Choose the Right Mutual Fund for Your Financial Goals

With thousands of mutual funds available, picking the right one can feel overwhelming. But the secret to successful investing isn’t chasing the “best” fund—it’s choosing the one that aligns with your financial goals, time horizon, and risk appetite.

Thank you for reading this post, don't forget to subscribe!Let’s walk through a step-by-step guide to selecting mutual funds that work for you, not against you.

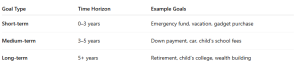

🎯 Step 1: Define Your Financial Goals

Before you invest, get clear on why you’re investing.

🧠 Step 2: Assess Your Risk Profile

Ask yourself:

- Can you handle market ups and downs?

- Do you panic during volatility or stay calm?

- Are you a conservative, moderate, or aggressive investor?

📌 Tip: Use a risk profiler tool or talk to an advisor for clarity.

📊 Step 3: Match Funds to Goals & Risk

Examples:

- For a 1-year goal → Liquid Fund

- For a 5-year goal → Aggressive Hybrid Fund

- For retirement in 25 years → Large-Cap or Flexi-Cap Equity Fund

📈 Step 4: Look at Key Fund Metrics

Once you’ve shortlisted fund categories, compare funds using these metrics:

✅ Fund Performance: Check 3-, 5-, and 10-year returns

✅ Consistency: Has it beaten its benchmark consistently?

✅ Expense Ratio: Lower is better (especially for long-term)

✅ Fund Manager Experience: Tenure and track record matter

✅ Assets Under Management (AUM): Not too small, not too bulky

✅ Portfolio Quality: Look at stock/bond selection

📌 Use trusted portals like Value Research, Morningstar, or Moneycontrol to evaluate.

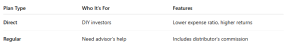

🔄 Step 5: Choose Between Direct vs Regular Plans

💡 If you’re confident in your research, go Direct.

🔍 Real-Life Example

Anita, Age 28

- Goal: Buy a house in 7 years

- Risk Profile: Moderate

- Strategy: Invest via SIP in a Flexi-Cap Fund + Hybrid Equity Fund

Result: Balanced exposure to equity with cushion from debt, aligned with her goal and temperament.

⚠️ Common Mistakes to Avoid

🚫 Chasing last year’s top performer

🚫 Picking too many funds (3–4 well-chosen ones are enough)

🚫 Ignoring fund reviews and rebalancing

🚫 Overlooking the importance of goal alignment

Conclusion

Choosing the right mutual fund isn’t about timing the market—it’s about aligning your investments with your financial goals and risk profile.

Start by knowing your “why,” select the right category, assess fund quality, and invest with discipline.

Remember: The best mutual fund is the one that suits you.

🚀 Need Help Building a Goal-Based Mutual Fund Portfolio?

At Goodwill Wealth Management, we create personalized mutual fund strategies based on your goals, time frame, and risk tolerance.

Talk to our advisors today and take the guesswork out of investing.