How to Evaluate a Company Before Buying Its Stock

How to Evaluate a Company Before Buying Its Stock

Stock investing isn’t about tips, trends, or Twitter buzz—it’s about understanding the business behind the stock. Successful investors like Warren Buffett spend more time studying companies than staring at stock prices.

Thank you for reading this post, don't forget to subscribe!Before you buy shares of any company, you need to evaluate whether it’s financially sound, well-managed, and has growth potential. Let’s explore the key metrics, steps, and red flags to help you make smarter investment decisions.

Step-by-Step Guide to Evaluating a Company

✅ 1. Understand the Business

Before you check numbers, ask:

- What does the company do?

- Is it easy to understand?

- Does it have a strong brand, market presence, or competitive edge?

Example:

HUL sells daily-use products like Dove, Surf Excel, and Lifebuoy. Easy to understand, wide moat.

If you don’t understand how a company makes money, it’s best to stay away.

📊 2. Analyze Financial Statements

These give you a clear picture of how the company is performing.

🔹 Income Statement (Profit & Loss)

- Revenue Growth: Is sales increasing year-on-year?

- Net Profit Margin: Profit after tax ÷ Revenue. Higher = better profitability.

🔹 Balance Sheet

- Debt-to-Equity Ratio: A low ratio (ideally <1) means manageable debt.

- Reserves & Surplus: Indicates retained earnings and financial strength.

🔹 Cash Flow Statement

- Operating Cash Flow: Positive cash flow = healthy business.

- Avoid companies with high profits but negative cash flow.

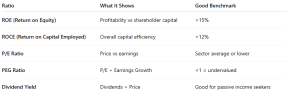

📈 3. Look at Key Ratios

These help you compare companies across sectors:

🧠 4. Qualitative Factors to Check

🔹 Management Quality

- Are the promoters credible?

- Do they avoid legal controversies?

- Are they increasing their stake or selling?

🔹 Industry Position

- Is the company a market leader?

- Is the sector growing or saturated?

🔹 Innovation & Adaptability

- How well does the company adapt to technology or market shifts?

📅 5. Study Historical Performance

Look at:

- 5-year CAGR of revenue and net profit

- Past 10-year stock performance

- EPS growth over time

This tells you whether the company is consistently growing or just had a few lucky years.

⚠️ 6. Red Flags to Watch Out For

🚩 Sudden drop in promoter holding

🚩 Frequent changes in auditors

🚩 High or rising debt with poor cash flows

🚩 Overpromising in investor calls or flashy marketing

🚩 Legal troubles or regulatory investigations

Even one red flag warrants deeper analysis or avoiding the stock entirely.

🧪 Real-Life Example: Infosys

Before investing in Infosys, an investor might check:

- Revenue and net profit CAGR over 5 years

- ROE ~25%, strong balance sheet, low debt

- Consistent dividend payout

- High promoter credibility

- Strong global client base in IT services

Result: A fundamentally sound, blue-chip stock with long-term potential.

Conclusion

Evaluating a company before investing is like doing a background check before a partnership. Numbers tell one part of the story, but understanding the business model, leadership, and long-term prospects completes the picture.

Whether you’re a beginner or a seasoned investor, following a systematic stock evaluation framework will help you avoid costly mistakes and build lasting wealth.

🚀 Want Help Evaluating Stocks?

At Goodwill Wealth Management, our experts help you decode balance sheets, compare company fundamentals, and create a stock watchlist tailored to your risk appetite.

Schedule a call and invest in businesses—not just stock symbols.