How to Read a Mutual Fund Factsheet Like a Pro

How to Read a Mutual Fund Factsheet Like a Pro

Ever come across a mutual fund factsheet and felt overwhelmed by the numbers, graphs, and jargon?

Thank you for reading this post, don't forget to subscribe!A mutual fund factsheet is like a report card for your fund—updated monthly by the fund house. But knowing what to look for can help you make smarter investment decisions.

Let’s break down each section so you can read a factsheet like a pro—and never miss red flags or golden opportunities.

What Is a Mutual Fund Factsheet?

A mutual fund factsheet is a standardized document released by Asset Management Companies (AMCs), summarizing a fund’s:

- Performance

- Portfolio composition

- Risk metrics

- Asset allocation

- Key information like expense ratio, NAV, fund manager, etc.

📌 It tells you whether your fund is doing what it promised—and whether it still fits your goals.

Key Sections of a Mutual Fund Factsheet (and What They Mean)

Basic Fund Details

Includes:

- Fund Name & Category: E.g., “ABC Large Cap Fund – Direct – Growth”

- Fund House: The AMC managing the fund

- Fund Manager(s): Experience and tenure matter

- Inception Date: Helps judge long-term performance

- AUM (Assets Under Management): Higher AUM = investor trust, but too large can limit flexibility

📌 Pro Tip: Prefer fund managers with at least 3–5 years tenure in the same fund.

NAV (Net Asset Value)

- NAV is the price per unit of the fund.

- Shown as of a specific date (e.g., “₹142.58 as of April 30, 2025”)

📌 Pro Tip: NAV alone doesn’t indicate fund quality. Look at returns over time instead.

Performance Data

Compares fund returns over:

- 1 year, 3 years, 5 years, and since inception

- Versus its benchmark index (e.g., Nifty 50, Crisil Short-Term Bond Index)

- Includes CAGR (Compounded Annual Growth Rate)

📌 Pro Tip: Check consistency. A fund that beats its benchmark across timeframes is reliable.

Portfolio Allocation

Breaks down where the fund invests:

- Equity Funds: Top sectors, top holdings, market cap allocation (large/mid/small)

- Debt Funds: Credit quality, duration, top issuers

- Hybrid Funds: Mix of debt, equity, gold, etc.

📌 Pro Tip: For equity funds, check for diversification and overexposure.

For debt funds, ensure a high-quality credit profile (AAA-rated instruments preferred).

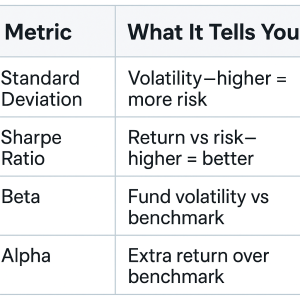

Risk Ratios

Expense Ratio

This is the annual cost of managing the fund, expressed as a % of AUM.

- Lower is better, especially in passive or debt funds.

- Direct plans have lower expense ratios than regular plans.

📌 Pro Tip: Even a 1% difference in expense ratio can significantly impact long-term returns.

Exit Load

This is the fee charged for early withdrawal. Common in equity funds (usually 1% if redeemed within 1 year).

📌 Pro Tip: Know the exit load terms if you’re investing short-term or planning redemptions.

Fund Manager Commentary

Provides monthly insights on:

- Market outlook

- Portfolio strategy changes

- Sectoral views

📌 Pro Tip: Read between the lines. If commentary becomes vague or overly cautious, it may signal future underperformance.

Red Flags to Watch Out For

🔺 Fund consistently underperforming benchmark

🔺 Very high expense ratio for average performance

🔺 Frequent churn in portfolio or sector concentration

🔺 New fund manager with no track record

🔺 Drop in AUM without a clear explanation

Conclusion

A mutual fund factsheet is more than just data—it’s your toolkit for better investment decisions.

When you know what to look for, you can judge whether to invest, stay, or exit.

Whether you’re a DIY investor or working with an advisor, reading the factsheet monthly or quarterly ensures you’re always in control of your money.

Need Help Understanding Your Funds?

At Goodwill Wealth Management, we decode mutual fund factsheets for you and help you pick funds that align with your goals, risk appetite, and time horizon.

Talk to our experts and invest like a pro—with complete clarity.