How to Start a SIP for Your Child’s Education or Future Goals

How to Start a SIP for Your Child’s Education or Future Goals

Every parent dreams of giving their child the best—especially when it comes to education, career, and a secure future. But with rising costs of college and inflation eroding savings, the key is to start planning early.

Thank you for reading this post, don't forget to subscribe!One of the smartest ways to build a future-ready fund is through a Systematic Investment Plan (SIP) in mutual funds. It allows you to invest small amounts regularly, harness the power of compounding, and stay financially prepared for your child’s dreams.

Let’s walk through how to set up a SIP for your child’s future.

Why Plan Early for Your Child’s Goals?

📌 Rising Costs:

- Higher education in India or abroad can cost ₹20–50 lakhs (or more) in 10–15 years.

📌 Inflation Impact:

- ₹10 lakhs today might not be enough when your child turns 18.

📌 Power of Compounding:

- The earlier you start, the more time your money has to grow—even with small monthly investments.

What Is a SIP?

SIP (Systematic Investment Plan) lets you invest a fixed amount regularly (monthly/quarterly) in a mutual fund scheme. It encourages discipline and rupee-cost averaging while compounding your wealth over time.

Step-by-Step Guide to Starting a SIP for Your Child’s Future

1. Define the Goal

Be specific about what you’re saving for:

🎓 Education (engineering, medical, MBA, abroad)

🏠 Marriage

🚀 Seed money for startup or business

👉 Estimate the future cost using an inflation-adjusted calculator.

2. Set a Time Horizon

Usually 10–18 years depending on your child’s age.

Example: Your child is 5 years old now, and you need funds at 18 ⇒ Time horizon = 13 years.

3. Calculate the Monthly SIP Amount

Use an SIP calculator. For example:

🎯 Goal: ₹30 lakhs

⏳ Time: 15 years

📈 Expected Return: 12% p.a.

💰 Monthly SIP needed ≈ ₹6,000–₹7,000

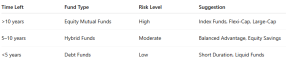

4. Choose the Right Mutual Fund Category

Based on your time horizon and risk appetite:

Tip: For long-term goals like education, equity is essential to beat inflation.

5. Start the SIP Online

- Choose a fund house or platform (like Zerodha Coin, Groww, Paytm Money, AMC websites)

- Complete KYC (PAN, Aadhaar, bank details)

- Set up an auto-debit mandate

- Monitor performance annually

6. Create a Dedicated Child Goal Portfolio

Don’t mix this SIP with your emergency fund or retirement planning.

🗂 Create a separate folio or investment tracker tagged “Child’s Education Goal”.

Review & Rebalance

Review your portfolio once a year. As the goal nears (last 3–5 years), gradually shift from equity to debt to protect gains.

🛑 Mistakes to Avoid

❌ Delaying investment—compromising the compounding benefit

❌ Picking funds without research or based on recent returns

❌ Not reviewing or adjusting SIPs over time

❌ Dipping into the fund for non-goal purposes

Conclusion

Starting a SIP today for your child’s future can be one of the most powerful financial gifts you’ll ever give. It not only builds a corpus but also ensures peace of mind when the time comes.

Small amounts + discipline + time = Big results.

🚀 Need Help Planning Your Child’s Future?

At Goodwill Wealth Management, we help parents design custom SIP strategies based on their child’s age, educational goals, and inflation-adjusted needs.

Get in touch with our experts and start securing your child’s dreams today.