How to Start Investing in the Stock Market with Just ₹500

How to Start Investing in the Stock Market with Just ₹500

Think stock market investing is only for the rich? Think again. Thanks to digital platforms, fractional investing, and low-cost products, you can now start your stock market journey with as little as ₹500.

Thank you for reading this post, don't forget to subscribe!Starting small not only builds discipline—it helps you learn, grow, and compound your wealth over time without taking big risks.

Let’s explore how you can start investing in the stock market even with a tight budget.

Is ₹500 Really Enough?

Yes! While ₹500 may seem small, it’s enough to buy units of mutual funds, ETFs, or even fractions of shares via direct platforms.

The key isn’t the amount—it’s the consistency and choice of investment that drives wealth creation.

What You Need to Start

✅ PAN Card

Mandatory for all stock market investments

✅ Aadhaar-linked Bank Account

For seamless transactions and KYC verification

✅ Demat + Trading Account

Open with any SEBI-registered broker (Zerodha, Groww, Upstox, etc.)

📌 Tip: Most brokers allow you to open an account for free or at minimal cost.

Step-by-Step: How to Start with ₹500

Step 1: Choose the Right Platform

Pick a user-friendly app or brokerage that allows:

- Fractional investing

- Low minimum SIPs

Access to direct mutual funds or stocks

Step 2: Decide Where to Invest ₹500

Here are smart options for beginners:

- Mutual Funds via SIP

- Start SIPs from ₹100/month

- Ideal: Index funds, large-cap funds, or balanced hybrid funds

- Use Direct Plans for higher returns (lower expense ratio)

- ETFs (Exchange-Traded Funds)

- Track indices like Nifty 50 or Sensex

- Trade like stocks but cost less

- Example: Invest in Nippon India Nifty BeES or HDFC Sensex ETF

- Stocks (If You Prefer DIY)

- Buy one or two shares of trusted, low-priced companies

- Focus on blue-chip or dividend-paying stocks

- Avoid penny stocks—low price doesn’t mean good value

Step 3: Invest Consistently

- Set up an auto-debit SIP

- Even ₹500/month = ₹6,000/year + compounding

Mindset Matters More Than Money

Starting with ₹500 builds:

- Discipline

- Learning habit

- Long-term vision

Most successful investors didn’t start rich—they started early and stayed consistent.

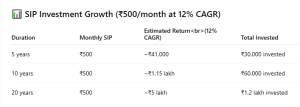

Example: The Power of ₹500 SIP

🔁 Small steps + long-term patience = big gains

Mistakes to Avoid

- Trying to time the market

- Chasing “hot tips” or trendy stocks

- Ignoring risk and diversification

- Skipping SIPs due to market noise

Conclusion

You don’t need lakhs to begin investing in the stock market—just the right tools, mindset, and consistency. With ₹500 and a solid plan, you can start small and dream big.

So, whether you’re a student, a young professional, or someone exploring the markets—start now. Your future self will thank you.

Need Help Getting Started?

At Goodwill Wealth Management, we help first-time investors build low-cost, beginner-friendly portfolios that grow with them.

Talk to our experts and begin your wealth-building journey—no matter the size of your first step.