IPO : Esprit Stones Limited

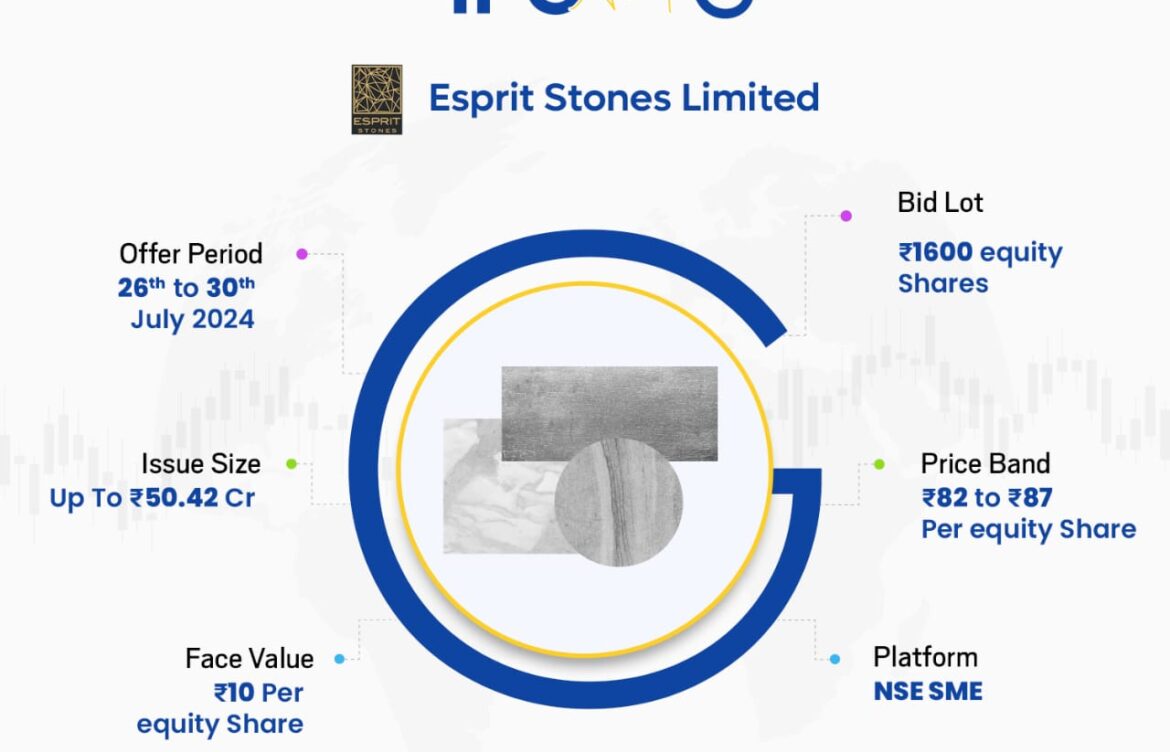

Esprit Stones Limited IPO

Esprit Stones Limited has been from 40 years in the business of high-quality natural stone surfaces. They are a synergy of an idea that brought together two business houses; Aravali and Gattani group to explore new frontiers and set new benchmarks in the engineered stones business.

Thank you for reading this post, don't forget to subscribe!| SYMBOL | ESPL |

| ISSUE TYPE | Book Built Issue IPO |

| ISSUE OPENS ON | Friday, July 26, 2024 |

| ISSUE CLOSES ON | Tuesday, July 30, 2024 |

| ISSUE PRICE | ₹82 to ₹87 per share |

| ISSUE SIZE | Up to Rs.50.42 Crores |

| FACE VALUE | Rs.10 per share |

Esprit Stones IPO is a book built issue of Rs 50.42 crores. The issue is entirely a fresh issue of 57.95 lakh shares.

Esprit Stones IPO opens for subscription on July 26, 2024 and closes on July 30, 2024. The allotment for the Esprit Stones IPO is expected to be finalized on Wednesday, July 31, 2024. Esprit Stones IPO will list on NSE SME with tentative listing date fixed as Friday, August 2, 2024.

| MINIMUM BID | 1600 shares |

| MINIMUM AMOUNT | Rs.139,200 |

| MAXIMUM BID | 1600 shares |

| MAXIMUM AMOUNT | Rs.139,200 |

| LISTING DATE | Friday, August 2, 2024 |

| LISTING AT | NSE-SME |

Esprit Stones IPO price band is set at ₹82 to ₹87 per share. The minimum lot size for an application is 1600 Shares. The minimum amount of investment required by retail investors is ₹139,200. The minimum lot size investment for HNI is 2 lots (3,200 shares) amounting to ₹278,400.

Objects of the Issue (Esprit Stones IPO Objectives)

The net proceeds of the Issue, i.e. gross proceeds of the Issue less the issue expenses to the extent applicable to the Issue (“Net Proceeds”) are proposed to be utilised for the following objects:

- Funding Working Capital requirement of the Company

- Investment in the Subsidiary, Haique Stones Private Limited (HSPL), for repayment and / or prepayment in part or full of its outstanding borrowings

- Investment in the Subsidiary, Haique Stones Private Limited (HSPL) for funding its Working Capital Requirement

- General Corporate Purpose

For Existing Clients : https://gudwil.in/IPO

Open an account : https://gudwil.in/smart

Further any clarification, feel free to contact your Branch / Relationship Manager.For all your investment needs feel free to reach us. Give us a missed call at 90037 90027. For Support: 044-40329999

Warm Regards,

Team GoodwillDISCLAIMER : Investments in the securities market are subject to market risk. Read all the related documents carefully before investing. The data and information herein provided are believed to be reliable, but Goodwill Wealth Management Pvt. Ltd., does not warrant its accuracy or completeness. Goodwill Wealth Management Pvt. Ltd., or any of its employees are not liable for any action taken by any party based on the above information. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Special note: Short-term trading on the basis of technical is high risk and skill-oriented venture and may result in huge losses also. Traders doing so are doing at their own risk. We are not responsible for any damages. Note: The material is being provided to you for educational purposes only and does not constitute investment advice; returns mentioned herein are in no way a guarantee or promise of future returns. See Disclaimer, Privacy Policy @ https://www.gwcindia.in/Disclaimer