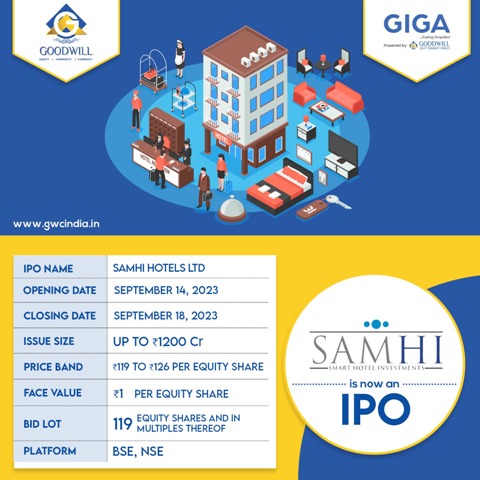

IPO : SAMHI Hotels Limited

SAMHI Hotels Limited IPO

Incorporated in 2010, SAMHI Hotels Limited is a branded hotel ownership and asset management platform in India.

Thank you for reading this post, don't forget to subscribe!SAMHI Hotels has a portfolio of 4,801 keys across 31 operating hotels in 14 of India’s key urban consumption centers, including Bengaluru, Karnataka; Hyderabad, Telangana; National Capital Region (NCR); Pune, Maharashtra; Chennai, Tamil Nadu; and Ahmedabad, Gujarat as of March 31, 2023. The company also has 2 hotels under development with a total of 461 keys in Kolkata and Navi Mumbai.

| SYMBOL | SAMHI |

| ISSUE TYPE | Book Built Issue IPO |

| ISSUE OPENS ON | September 14, 2023 (Thursday) |

| ISSUE CLOSES ON | September 18, 2023 (Monday) |

| ISSUE PRICE | Rs.119 To Rs.126 per share |

| ISSUE SIZE | Up to Rs.1,370.10 Crores |

| FACE VALUE | Rs.1 per share |

SAMHI has adopted an acquisition led strategy which is underpinned by its track record of acquiring and successfully turning around hotels to grow its business. SAMHI’s hotels operate under established and well-recognised hotel operator brands such as Courtyard by Marriott, Sheraton, Hyatt Regency, Hyatt Place, Fairfield by Marriott, Four Points by Sheraton and Holiday Inn Express, which provide its hotels access to the operator’s loyalty programs, management and operational expertise, industry best practices, online reservation systems and marketing strategies.

| MINIMUM BID | 119 shares |

| MINIMUM AMOUNT | Rs.14,994 |

| MAXIMUM BID | 1547 shares |

| MAXIMUM AMOUNT | Rs.1,94,922 |

| LISTING DATE | September 27,2023 (Wednesday) |

| LISTING AT | NSE-BSE |

On August 10, 2023, the company acquired Asiya Capital and the ACIC SPVs (the ACIC SSPA) which gained the company an additional 962 keys across six operating hotels and land for the development of a hotel in Navi Mumbai, Maharashtra.

SAMHI was incorporated in 2010, was sponsored by Sam Zell led Equity International, GTI Capital, International Finance Corporation amongst its shareholders. SAMHI was successfully listed in both the BSE and NSE in September 2023 through an Initial Public Offering with a primary raise of ₹ 12,000 million.

Objects of the Issue

The company intends to utilize the net proceeds from the issue towards the funding of the following objects:

- Repayment/ prepayment/ redemption, in full or in part, of certain borrowings availed of by the company and the subsidiaries including payment of the interest accrued thereon.

- General corporate purposes.

-

- SMART IPO using UPI, you can now apply online

For Existing Clients : https://gudwil.in/IPO

Open an account : https://gudwil.in/smartFurther any clarification, feel free to contact your Branch / Relationship Manager.For all your investment needs feel free to reach us. Give us a missed call at 90037 90027. For Support: 044-40329999Warm Regards,

Team GoodwillDISCLAIMER : Investments in the securities market are subject to market risk. Read all the related documents carefully before investing. The data and information herein provided are believed to be reliable, but Goodwill Wealth Management Pvt. Ltd., does not warrant its accuracy or completeness. Goodwill Wealth Management Pvt. Ltd., or any of its employees are not liable for any action taken by any party based on the above information. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Special note: Short-term trading on the basis of technical is high risk and skill-oriented venture and may result in huge losses also. Traders doing so are doing at their own risk. We are not responsible for any damages. Note: The material is being provided to you for educational purposes only and does not constitute investment advice; returns mentioned herein are in no way a guarantee or promise of future returns. See Disclaimer, Privacy Policy @https://www.gwcindia.in/Disclaimer

- SMART IPO using UPI, you can now apply online