IPO : Sanstar Limited

Sanstar Limited IPO

We are one of the major manufacturers of plant-based speciality products and ingredient solutions in India for food, animal nutrition and other industrial applications, with an installed capacity of 1,100 metric tons per day. Through complex, multi-step value addition and manufacturing process, we turn maize into ingredients and solutions that add taste, texture, nutrients and increased functionality to (i) foods as ingredients, thickening agents, stabilizers, sweeteners, emulsifiers and additives in food products (bakery products, confectionery, pastas, soups, ketchups, sauces, creams, deserts, amongst others), (ii) animal nutrition products as nutritional ingredients, and (iii) other industrial products as disintegrants, excipients, supplements, coating agents, binders, smoothing & flattering agents, finishing agents, among others.

Thank you for reading this post, don't forget to subscribe!| SYMBOL | SANSTAR |

| ISSUE TYPE | Book Built Issue IPO |

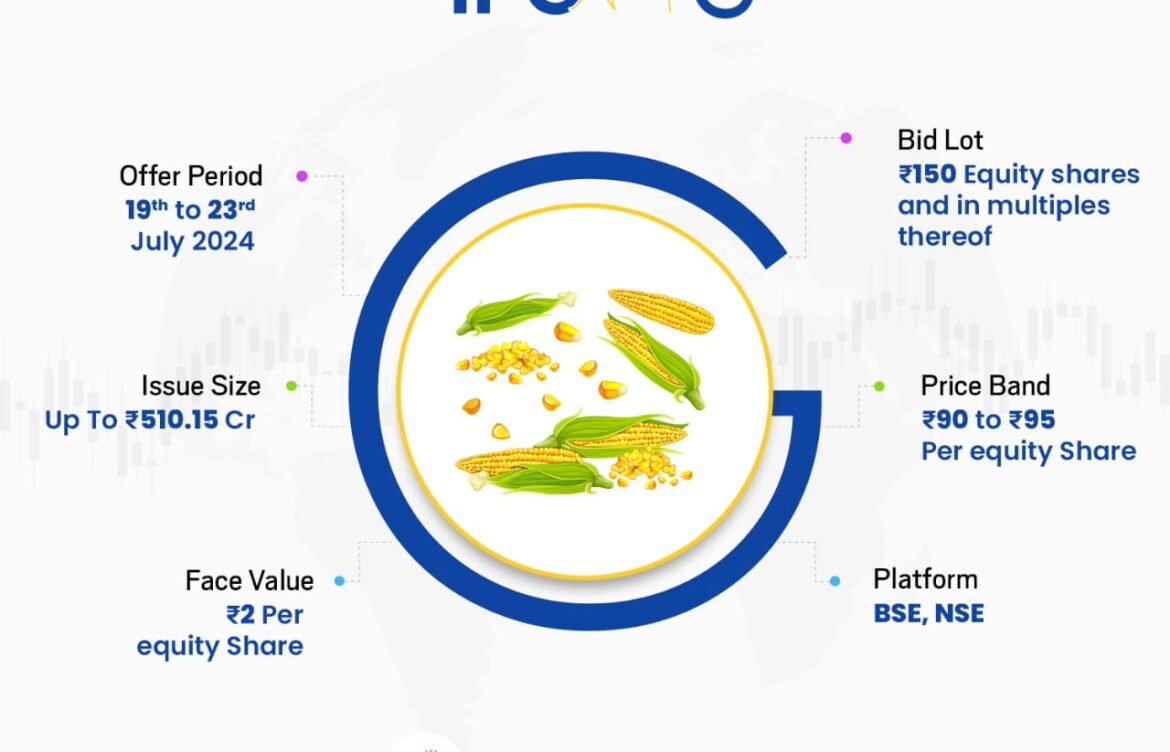

| ISSUE OPENS ON | Friday, July 19, 2024 |

| ISSUE CLOSES ON | Tuesday, July 23, 2024 |

| ISSUE PRICE | ₹90 to ₹95 per share |

| ISSUE SIZE | Up to Rs.510.15 Crores |

| FACE VALUE | Rs.2 per share |

Sanstar IPO is a book built issue of Rs 510.15 crores. The issue is a combination of fresh issue of 4.18 crore shares aggregating to Rs 397.10 crores and offer for sale of 1.19 crore shares aggregating to Rs 113.05 crores.

Sanstar IPO bidding opened for subscription on July 19, 2024 and will close on July 23, 2024. The allotment for the Sanstar IPO is expected to be finalized on Wednesday, July 24, 2024. Sanstar IPO will list on BSE, NSE with tentative listing date fixed as Friday, July 26, 2024.

| MINIMUM BID | 150 shares |

| MINIMUM AMOUNT | Rs.14,250 |

| MAXIMUM BID | 2100 shares |

| MAXIMUM AMOUNT | Rs.199,500 |

| LISTING DATE | Friday, July 26, 2024 |

| PROMOTER HOLDING POST ISSUE | 70.37% |

| LISTING AT | NSE-BSE |

Sanstar IPO price band is set at ₹90 to ₹95 per share. The minimum lot size for an application is 150 Shares. The minimum amount of investment required by retail investors is ₹14,250. The minimum lot size investment for sNII is 15 lots (2,250 shares), amounting to ₹213,750, and for bNII, it is 71 lots (10,650 shares), amounting to ₹1,011,750.

Objects of the Issue (Sanstar IPO Objectives)

The Net Proceeds of the Fresh Issue, i.e., Gross Proceeds of the Fresh Issue less the offer expenses apportioned to the Company are proposed to be utilized in the following manner:

- Funding the capital expenditure requirement for the expansion of the Dhule Facility;

- Repayment and/or pre-payment, in part or full, of certain borrowings availed by the Company, and;

- General Corporate Purposes.

For Existing Clients : https://gudwil.in/IPO

Open an account : https://gudwil.in/smart

Further any clarification, feel free to contact your Branch / Relationship Manager.For all your investment needs feel free to reach us. Give us a missed call at 90037 90027. For Support: 044-40329999

Warm Regards,

Team GoodwillDISCLAIMER : Investments in the securities market are subject to market risk. Read all the related documents carefully before investing. The data and information herein provided are believed to be reliable, but Goodwill Wealth Management Pvt. Ltd., does not warrant its accuracy or completeness. Goodwill Wealth Management Pvt. Ltd., or any of its employees are not liable for any action taken by any party based on the above information. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Special note: Short-term trading on the basis of technical is high risk and skill-oriented venture and may result in huge losses also. Traders doing so are doing at their own risk. We are not responsible for any damages. Note: The material is being provided to you for educational purposes only and does not constitute investment advice; returns mentioned herein are in no way a guarantee or promise of future returns. See Disclaimer, Privacy Policy @ https://www.gwcindia.in/Disclaimer