IPO : VVIP Infratech Limited

VVIP Infratech Limited IPO

VVIP, since 2001, stands as a top-tier Class “A” civil and electrical contractor. Specializing in infrastructure projects like sewer treatment plants, water facilities, roads, and electrification, VVIP boasts innovation and in-depth expertise, ensuring timely project completion. Primarily serving regions like Uttar Pradesh, Uttarakhand, NCT of Delhi, and northern India, the company has cemented its position as a preferred choice in sewer treatment projects. Embracing automation and modern techniques, VVIP has successfully delivered numerous key infrastructure projects, gaining a robust reputation for its execution prowess. Committed to continuous growth, the company aims for the pinnacle of engineering excellence, efficiency, and economy.

Thank you for reading this post, don't forget to subscribe!| SYMBOL | VVIPIL |

| ISSUE TYPE | Book Built Issue IPO |

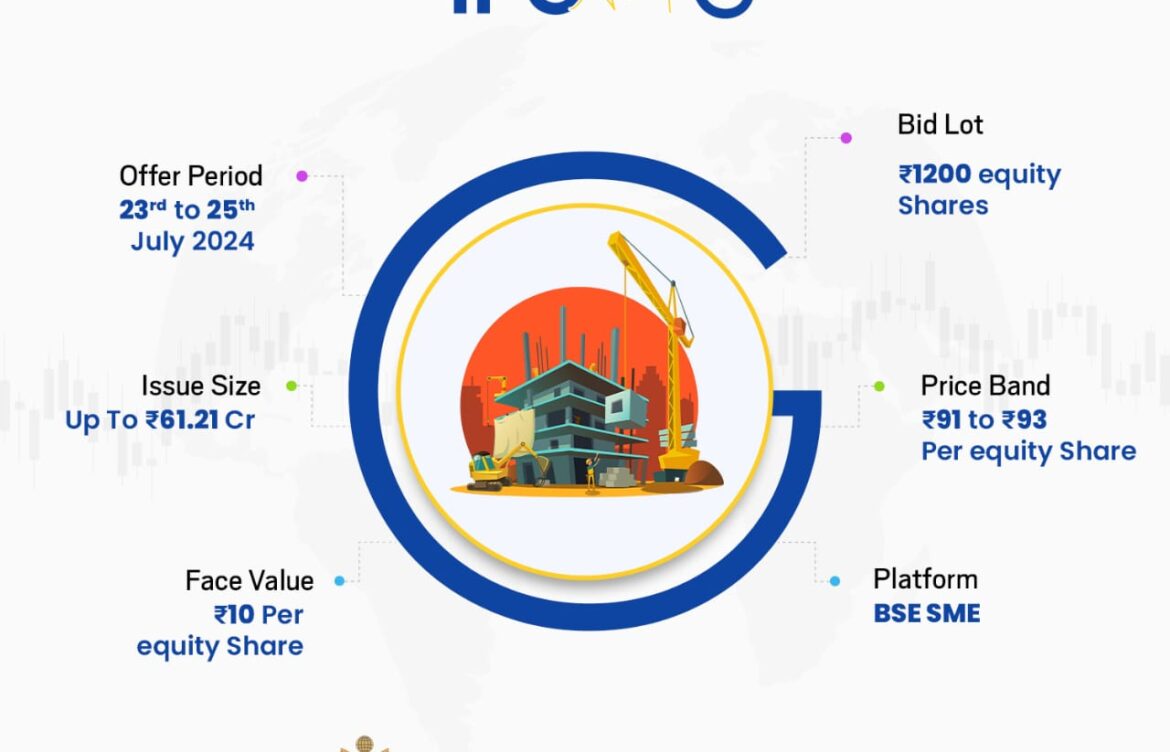

| ISSUE OPENS ON | Tuesday, July 23, 2024 |

| ISSUE CLOSES ON | Thursday, July 25, 2024 |

| ISSUE PRICE | ₹91 to ₹93 per share |

| ISSUE SIZE | Up to Rs.61.21 Crores |

| FACE VALUE | Rs.10 per share |

VVIP Infratech IPO is a book built issue of Rs 61.21 crores. The issue is entirely a fresh issue of 65.82 lakh shares.

VVIP Infratech IPO opens for subscription on July 23, 2024 and closes on July 25, 2024. The allotment for the VVIP Infratech IPO is expected to be finalized on Friday, July 26, 2024. VVIP Infratech IPO will list on BSE SME with tentative listing date fixed as Tuesday, July 30, 2024.

| MINIMUM BID | 1200 shares |

| MINIMUM AMOUNT | Rs.111,600 |

| MAXIMUM BID | 1200 shares |

| MAXIMUM AMOUNT | Rs.111,600 |

| LISTING DATE | Tuesday, July 30, 2024 |

| LISTING AT | BSE-SME |

VVIP Infratech IPO price band is set at ₹91 to ₹93 per share. The minimum lot size for an application is 1200 Shares. The minimum amount of investment required by retail investors is ₹111,600. The minimum lot size investment for HNI is 2 lots (2,400 shares) amounting to ₹223,200.

Objects of the Issue (VVIP Infratech IPO Objectives)

The company intends to utilize the proceeds of the Issue to meet the following objectives:

- Capital Expenditure

- Working Capital Requirement

- General Corporate Purpose

- Issue Expense

For Existing Clients : https://gudwil.in/IPO

Open an account : https://gudwil.in/smart

Further any clarification, feel free to contact your Branch / Relationship Manager.For all your investment needs feel free to reach us. Give us a missed call at 90037 90027. For Support: 044-40329999

Warm Regards,

Team GoodwillDISCLAIMER : Investments in the securities market are subject to market risk. Read all the related documents carefully before investing. The data and information herein provided are believed to be reliable, but Goodwill Wealth Management Pvt. Ltd., does not warrant its accuracy or completeness. Goodwill Wealth Management Pvt. Ltd., or any of its employees are not liable for any action taken by any party based on the above information. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Special note: Short-term trading on the basis of technical is high risk and skill-oriented venture and may result in huge losses also. Traders doing so are doing at their own risk. We are not responsible for any damages. Note: The material is being provided to you for educational purposes only and does not constitute investment advice; returns mentioned herein are in no way a guarantee or promise of future returns. See Disclaimer, Privacy Policy @ https://www.gwcindia.in/Disclaimer