SIP: The Smartest Way to Start Investing Monthly

SIP: The Smartest Way to Start Investing Monthly

In an era of financial uncertainty, building long-term wealth doesn’t have to be complicated. Enter the Systematic Investment Plan (SIP)—a simple, disciplined approach to investing in mutual funds that fits effortlessly into your monthly routine.

Thank you for reading this post, don't forget to subscribe!Whether you’re just starting your investment journey or looking to bring consistency to your financial goals, SIPs offer the ideal foundation.

What Is a SIP?

A Systematic Investment Plan (SIP) is a method of investing a fixed amount regularly—typically monthly—into a mutual fund. Instead of trying to time the market, SIPs encourage consistent investing regardless of market highs or lows.

Think of it like a monthly subscription, but for your future wealth.

How Does a SIP Work?

Here’s a quick breakdown:

- 1. You choose a mutual fund scheme.

- 2. Decide on the investment amount (as low as ₹500/month).

- 3. Set your frequency (monthly, quarterly, etc.).

- 4. The amount gets auto-debited and invested into the fund at the prevailing NAV (Net Asset Value).

- 5. Over time, this approach averages out your cost and compounds your wealth.

1. Power of Compounding

When you invest regularly and stay invested for the long term, your earnings start generating returns. This compounding effect can transform small monthly amounts into substantial wealth.

Example: ₹5,000/month for 15 years at 12% annual returns = ~₹25 lakhs

2. Rupee Cost Averaging

Markets rise and fall—but SIPs help you benefit from this volatility. You buy more units when prices are low and fewer when they’re high, bringing down your average purchase cost.

3. Financial Discipline

SIPs cultivate a habit of saving and investing. Since the amount is deducted automatically, you’re less tempted to spend impulsively.

4. Low Entry Barrier

Starting with just ₹500/month removes the pressure of large capital. SIPs are perfect for young professionals, students, and salaried individuals alike.

5. Goal-Oriented Investing

Whether it’s for a new home, your child’s education, or early retirement, SIPs can be aligned with specific life goals. This helps you track progress and stay motivated.

Taxation of SIPs

Equity Mutual Funds

Short-Term Capital Gains (STCG): Taxed at 15% if sold within 12 months.

Long-Term Capital Gains (LTCG): Gains over ₹1 lakh are taxed at 10% after 1 year.

(Each SIP installment is considered a new investment — so its own 1-year clock starts from that date.)

Debt Mutual Funds (Post-April 2023 Update)

Gains are now added to your income and taxed as per your income slab, regardless of holding period.

Indexation benefit removed.

ELSS (Equity-Linked Saving Scheme)

-

Lock-in of 3 years (longest among mutual funds).

-

Returns taxed as LTCG at 10% beyond ₹1 lakh.

You also get Section 80C tax deduction up to ₹1.5 lakh annually.

SIP Returns Over the Years

SIP returns can vary depending on the mutual fund type (large-cap, mid-cap, hybrid, etc.) and the market cycle. However, the long-term data is encouraging.

Why Starting Early Makes All the Difference in SIPs

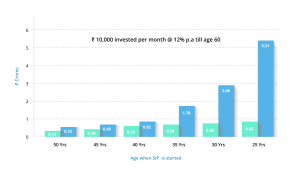

When it comes to investing, time is your biggest asset. The chart below powerfully demonstrates how starting a SIP at a younger age can multiply your wealth—without increasing the monthly amount.

Let’s break this down:

If you invest ₹10,000 per month at 12% p.a. until the age of 60, here’s what you could accumulate based on when you start:

Conclusion:

Systematic Investment Plans (SIPs) aren’t just an investment method—they’re a financial habit that rewards consistency, discipline, and patience. Whether you’re 25 or 45, the earlier you start, the greater your potential to build long-term wealth.

With benefits like rupee cost averaging, tax efficiency, goal-oriented planning, and the power of compounding, SIPs are ideal for both first-time investors and seasoned professionals looking for a smarter way to grow money.

📅 Start small. Stay consistent. Let time and discipline do the heavy lifting.