Systematic Withdrawal Plan (SWP): The Opposite of SIP Explained

Systematic Withdrawal Plan (SWP): The Opposite of SIP Explained

You’ve probably heard of SIPs—Systematic Investment Plans—where you invest a fixed amount regularly in mutual funds. But what if you need regular income from your investments instead?

Thank you for reading this post, don't forget to subscribe!Enter the Systematic Withdrawal Plan (SWP)—a powerful yet underused feature that offers consistent cash flows without redeeming your entire investment.

Whether you’re retired, need a second income, or want tax-efficient withdrawals, SWP could be the solution. Let’s break it down.

What Is a Systematic Withdrawal Plan (SWP)?

An SWP allows you to withdraw a fixed amount of money from your mutual fund investment at regular intervals—monthly, quarterly, or annually.

✅ You stay invested in the fund

✅ Your money keeps growing

✅ You withdraw only a part, not the whole

It’s like getting a salary from your own investment.

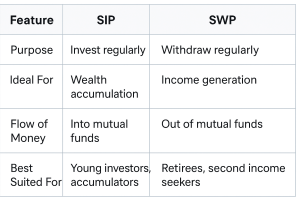

SWP vs SIP: A Mirror Image

How SWP Works

Let’s say you invest ₹10 lakh in a debt mutual fund and set up an SWP of ₹10,000 per month.

- Each month, ₹10,000 is credited to your bank account

- The remaining amount stays invested and continues to earn returns

- You can stop, modify, or pause the SWP anytime

Benefits of SWP

✅ Regular Cash Flow

Get a stable, predictable monthly income—ideal for retirees or freelancers.

✅ Capital Preservation + Growth

Unlike FD interest payouts, your principal remains invested and can grow over time.

✅ Tax Efficiency

SWP withdrawals are considered redemptions, not income:

- Only capital gains are taxed

- Lower tax rates than interest income

- Long-term gains (after 3 years in debt funds) taxed at 20% with indexation benefits

✅ Flexibility

- Set any withdrawal amount and frequency

- Can be started/stopped at any time

- Choose the best fund as per your needs (equity, hybrid, or debt)

Real-Life Example: Mr. Sharma’s Retirement Plan

Mr. Sharma, aged 60, retires with ₹30 lakh invested in a low-risk debt mutual fund.

He sets up an SWP of ₹20,000 per month to cover monthly expenses.

Over time:

- He continues to earn returns (6–7%) on his remaining investment

- Withdraws capital gradually

- Pays less tax compared to FD or annuity income

⚠️ Things to Keep in Mind

Choose Fund Wisely: For regular income, prefer debt or hybrid funds with low volatility

Avoid Overdrawing: If withdrawals exceed returns, your capital will erode

Plan for Inflation: Consider increasing your SWP amount annually

Tax Planning: Track short- vs long-term gains based on holding period

When Should You Use an SWP?

Use SWP If You:

- Are retired and need monthly income

- Want tax-efficient withdrawals

- Have a lump sum to invest but want phased usage

- Are building a second income stream without stopping growth

SWP Is Not Ideal If:

- You need guaranteed income (FDs or annuities are better)

- You’re investing in highly volatile funds (e.g., small-cap equity)

- You haven’t held the fund long enough (can trigger short-term capital gains tax)

Conclusion

SWP is the reverse of SIP—designed to help you enjoy the fruits of your investment.

It’s a smart way to generate regular income, manage taxes, and keep your wealth growing.

Whether you’re entering retirement or just want your money to work harder while giving you cash flow, SWP can be a simple yet powerful tool in your investment strategy.

Want to Set Up an SWP?

At Goodwill Wealth Management, we help you plan customized SWPs for retirement, monthly expenses, or passive income—based on your fund type, tax position, and cash flow needs.

Talk to our experts today and create an income stream that works for you.