Understanding Market Capitalization: Small-Cap vs Mid-Cap vs Large-Cap

Understanding Market Capitalization: Small-Cap vs Mid-Cap vs Large-Cap

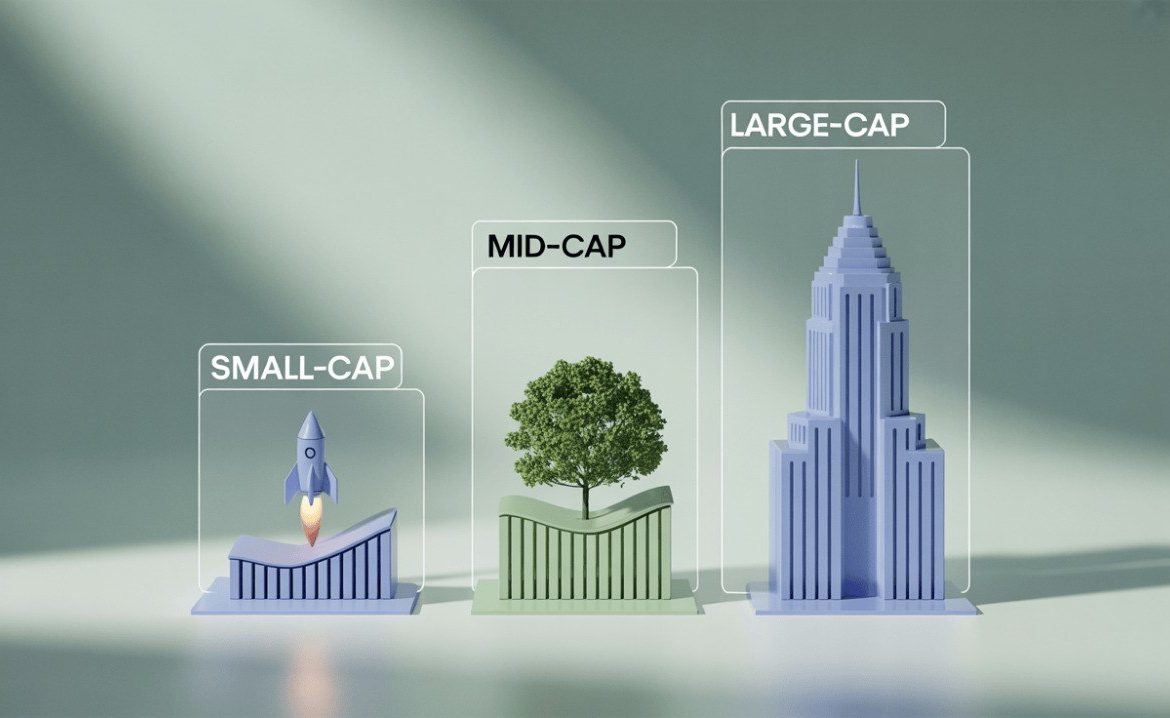

When you hear terms like small-cap, mid-cap, or large-cap in investing—what exactly do they mean?

Thank you for reading this post, don't forget to subscribe!These categories are based on market capitalization, which helps investors understand a company’s size, risk level, and potential for growth.

Knowing the difference can help you diversify your portfolio smartly and invest according to your risk appetite and financial goals.

Let’s break it down.

What Is Market Capitalization?

Market Capitalization (Market Cap) is the total value of a company’s outstanding shares:

Market Cap = Share Price × Total Number of Shares Outstanding

It’s a quick way to measure how big a company is in the stock market.

Types of Market Capitalization in India

As defined by SEBI (Securities and Exchange Board of India), here’s how companies are categorized:

1️⃣ Large-Cap Companies

- Top 100 companies by market cap

- Examples: Reliance Industries, HDFC Bank, TCS

- Market Cap: ₹50,000+ crores (approx.)

✅ Features:

- Stable and well-established

- Lower volatility

- Suitable for conservative investors

2️⃣ Mid-Cap Companies

- Rank 101–250 by market cap

- Examples: Tata Power, Bharat Forge, Trent

- Market Cap: ₹15,000–₹50,000 crores (approx.)

✅ Features:

- Balance of growth and stability

- Moderate risk and returns

- Good for medium- to long-term investors

3️⃣ Small-Cap Companies

- Beyond 250th rank

- Examples: BSE Ltd, KNR Constructions, Vaibhav Global

- Market Cap: <₹15,000 crores (approx.)

✅ Features:

- High growth potential

- Higher risk and volatility

- Ideal for aggressive, long-term investors

How They Differ in Risk & Return

Real-Life Portfolio Mix Example

Anil, Age 32 – Moderate Risk Tolerance

- 50% Large-Cap Fund

- 30% Mid-Cap Fund

- 20% Small-Cap Fund

This mix offers stability through large-caps while capturing growth through mid and small-caps.

When to Rebalance

Market movements can change your cap allocation over time. Regularly rebalance to maintain your desired exposure.

📌 Example: If small-caps outperform and grow from 20% to 30% of your portfolio, consider rebalancing by booking partial profits and shifting back into large or mid-cap funds.

🚫 Mistakes to Avoid

❌ Investing only in small-caps hoping to get rich quick

❌ Ignoring large-caps due to perceived “lower” returns

❌ Not aligning cap allocation with your financial goals and risk profile

❌ Getting swayed by recent performance trends

Conclusion

Understanding market capitalization helps you pick the right stocks or mutual funds for your unique investment strategy. A smart portfolio blends all three—large for stability, mid for growth, and small for aggressive gains—based on your risk appetite and goals.

🚀 Need Help With Cap-Based Investing?

At Goodwill Wealth Management, we guide you in building a well-balanced portfolio across small-, mid-, and large-cap funds tailored to your risk profile and time horizon.

Connect with our experts today and start investing smarter.