Understanding Sharpe Ratio: A Smart Way to Compare Funds

Understanding Sharpe Ratio: A Smart Way to Compare Funds

When choosing between two mutual funds, most people look only at returns. But returns without understanding risk can be misleading.

Thank you for reading this post, don't forget to subscribe!Enter the Sharpe Ratio—a powerful tool that helps you measure how much return a fund gives relative to the risk taken. In simple terms, it tells you whether a fund’s performance is worth the risk.

Let’s break it down in plain language and show how you can use the Sharpe Ratio to make smarter investment choices.

What Is the Sharpe Ratio?

The Sharpe Ratio is a number that tells you how much excess return you’re getting for every unit of risk you take.

Formula:

Sharpe Ratio = (Fund Return − Risk-Free Return) / Standard Deviation

- Fund Return: Annual return of the mutual fund

- Risk-Free Return: Return from a safe investment (e.g., government bond)

- Standard Deviation: Measures how volatile or risky the fund is

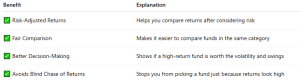

Why Is Sharpe Ratio Important?

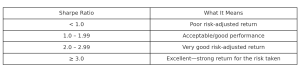

How to Interpret the Sharpe Ratio

📌 Higher Sharpe = Better reward for the risk taken

Real-Life Example

Let’s compare two large-cap equity mutual funds:

Though Fund B gives a higher return, Fund A is actually better in terms of risk-adjusted returns. It gives more return per unit of risk.

Where to Find Sharpe Ratio

You can easily find a fund’s Sharpe Ratio on:

- Value Research Online

- Morningstar India

- AMC websites

- Moneycontrol Fund Pages

✅ Compare Sharpe Ratios when choosing between funds in the same category (e.g., two mid-cap funds).

⚠️ Limitations of the Sharpe Ratio

- Doesn’t work well with non-volatile or irregular return products

- Best used when comparing similar funds

- Can be misleading if based on short-term data

🔁 Use in combination with other metrics like Alpha, Beta, Standard Deviation, and fund manager consistency

Bonus Tip: Sharpe Ratio in Portfolio Building

When constructing a portfolio:

- Choose funds with consistently high Sharpe Ratios

- A balanced portfolio (equity + debt) can improve overall Sharpe Ratio

- Add low-volatility funds to boost risk-adjusted returns

Conclusion

The Sharpe Ratio is one of the smartest ways to compare mutual funds—not just by return, but by how well they manage risk.

So, next time you’re picking a fund, don’t just look at how much it earned. Ask: Was it worth the risk? That’s what the Sharpe Ratio reveals.

🚀 Want Help Building a High Sharpe-Ratio Portfolio?

At Goodwill Wealth Management, we analyze mutual funds using Sharpe Ratios and other professional metrics to build smart, risk-optimized portfolios.

Talk to our experts to invest smarter—not riskier.