Understanding the Interplay of Construction, Infrastructure, and Related Sectors for Portfolio Growth

Understanding the Interplay of Construction, Infrastructure, and Related Sectors for Portfolio Growth

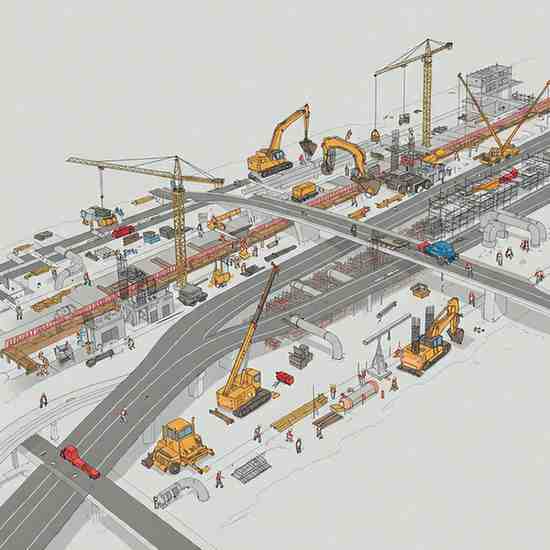

India’s economy is undergoing a dynamic transformation, fueled by substantial investments in infrastructure and urban development. This shift is creating promising avenues for investors focused on long-term portfolio growth. This analysis explores the intricate linkages between key sectors—construction, infrastructure, cement, railways, transport, and real estate—and highlights how a nuanced understanding of their interplay can guide strategic investment decisions. By examining the underlying drivers of these sectors, the piece aims to shed light on their potential influence on portfolio performance.

Thank you for reading this post, don't forget to subscribe!How do Construction Companies’ Stock Performance Reflect Infrastructure Development?

- Analyzing the Correlation:

- The performance of construction stocks in India is intrinsically linked to government initiatives and private investments in infrastructure projects.

- Factors such as project pipelines, contract awards, and execution efficiency significantly influence stock valuations. For example, large road and highway projects, or dam construction, will have a direct impact on the revenue of those companies involved.

- We will examine how fiscal policies and regulatory changes affect the viability of infrastructure stocks. Delays in land acquisition, or changes to environmental regulations, can severely impact projects.

- Consideration will be given to the impact of material costs and labor availability on project profitability. Rising steel or concrete prices, and skilled labor shortages, can erode profit margins.

- Long-Term Investment Potential:

- Assessing the sustainability of growth in the construction sector requires an understanding of long-term infrastructure plans. National Infrastructure Pipelines, for example, provide insight into future projects.

- Evaluating the financial health and project management capabilities of individual construction stocks is crucial for informed investment. Debt levels, and the ability to complete projects on time and within budget, are key indicators.

What is the Relationship Between Cement Demand and Real Estate Growth?

- Cement as a Key Indicator:

- The demand for cement stocks serves as a reliable indicator of activity in both the infrastructure and real estate stocks sectors.

- Fluctuations in cement prices and production volumes can provide insights into the overall health of these related markets. A surge in cement demand often signals increased building activity.

- The impact of affordable housing schemes on the demand of cement will be discussed. Government initiatives aimed at providing affordable housing directly increase the demand for building materials like cement.

- Real Estate Market Dynamics:

- Analyzing the factors driving the real estate stocks market, including urbanization, population growth, and housing affordability, is essential.

- We will explore how the availability of financing and regulatory reforms influence real estate development and, consequently, cement demand. Lower interest rates, and streamlined approval processes, can stimulate the real estate market, and subsequently the cement market.

How do Railway and Transport Sector Investments Impact the Broader Economy?

- Logistics and Efficiency:

- Investments in railway stocks and transport stocks are vital for improving logistics and reducing transportation costs.

- The development of freight corridors and enhanced connectivity contributes to the efficiency of supply chains and supports industrial growth. Faster and more reliable transport links reduce transit times and costs.

- Analyzing the impact of government spending on railway modernization. The development of high speed rail, and the electrification of existing lines, have large scale effects on the sector.

- Economic Multiplier Effect:

- The multiplier effect of infrastructure spending in the railway and transport sectors extends to other industries, creating employment opportunities and stimulating economic activity.

- Evaluating the impact of electric vehicle adoption on the transport stocks. The growth of the electric vehicle market, and the associated charging infrastructure, is transforming the transport sector.

What Factors Should Investors Consider When Evaluating Infrastructure Stocks?

- Project Execution and Risk Management:

- Evaluating the track record of infrastructure stocks in project execution and risk management is crucial.

- Understanding the financial leverage and debt-to-equity ratios of these companies helps assess their financial stability. High debt levels can make companies vulnerable to economic downturns.

- The impact of public private partnership on the growth of infrastructure companies. The involvement of private companies in public projects can bring expertise and efficiency.

- Regulatory Environment and Policy Changes:

- Investors must stay informed about regulatory changes and policy initiatives that affect the infrastructure sector.

- Government spending priorities and long-term infrastructure plans play a significant role in shaping investment opportunities. Government funding allocations, and policy shifts, can have major impacts.

How Does the Indian Market’s Specific Context Influence These Sectors?

- Unique Challenges and Opportunities:

- The Indian market presents unique challenges and opportunities due to its diverse demographics, geographical variations, and regulatory landscape.

- Understanding the specific regional dynamics and policy frameworks is essential for making informed investment decisions. Different states have different regulations, and varying levels of development.

- The impact of rural infrastructure spending on the overall growth. Investment in rural roads, and electrification, can significantly boost the rural economy.

- Long-Term Growth Potential:

- India’s developing economy presents a large market for long term growth in all the sectors mentioned.

- The increasing middle class and urbanization rates will drive demand. As more people move to cities, the need for housing, and infrastructure, increases.

- Related Blogs:

Top 5 Construction Stocks in India

How Construction & Infrastructure Stocks Can Enhance Your Portfolio’s Diversification

Top 5 Infrastructure Stocks to Buy in India in 2025

Beyond Construction: Exploring the Ripple Effect of Infrastructure Development on Related Sectors

The Infrastructure Ecosystem: Exploring Investment Opportunities in Allied Sectors alongside Construction

Top 5 Cement Stocks in India

Best Infrastructure Stocks in India

Best Cement Stocks in India

Top 5 Steel Stocks in India: A Guide for Investors in 2025

Top Stock Picks for 2025 Best Investment Opportunities

Top 5 Real Estate Stocks in India

Conclusion

The interplay between construction, infrastructure, cement, railways, transport, and real estate sectors offers diverse investment opportunities. A thorough understanding of the factors influencing these sectors, including government policies, market dynamics, and financial performance, is essential for informed portfolio growth. Investors should conduct detailed research and analysis to navigate this complex landscape and capitalize on the long-term potential of these interconnected industries. This analysis aims to provide a framework for evaluating these sectors within the Indian context, enabling investors to make well-informed decisions aligned with their financial objectives.

Related Blogs:

Best Steel Stocks in India in 2025

Top 5 Steel Stocks in India: A Guide for Investors in 2025

Best Steel Stocks in India

Diversifying Your Portfolio with India’s Steel Sector

Best Metal Stocks in India

Top 5 Metal Stocks in India

Best Aluminum Stocks in India

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.