What Is NAV? And Why It Matters in Mutual Fund Investing

What Is NAV? And Why It Matters in Mutual Fund Investing

When it comes to mutual fund investing, one term that frequently comes up is NAV, or Net Asset Value. For new investors, it may sound technical or even intimidating—but understanding what NAV means is crucial if you want to make informed decisions in your investment journey. In this blog, we’ll break down what NAV is, how it’s calculated, and why it plays a key role in evaluating mutual fund performance.

Thank you for reading this post, don't forget to subscribe!

What Is NAV (Net Asset Value)?

Net Asset Value (NAV) is the per-unit price of a mutual fund scheme. It represents the market value of all the securities held by the fund (its assets), minus its liabilities, divided by the total number of outstanding units.

In simple terms:

NAV = (Total Assets – Total Liabilities) / Number of Outstanding Units

The NAV is typically calculated at the end of every trading day, based on the closing market prices of the fund’s holdings. It tells investors how much one unit of the fund is worth.

Example of NAV Calculation

Suppose a mutual fund owns assets worth ₹500 crore and has liabilities worth ₹10 crore. If there are 10 crore units in circulation:

NAV = (₹500 crore – ₹10 crore) / 10 crore = ₹49 per unit

This ₹49 is what you’d pay to buy one unit of the fund that day.

Why Is NAV Important?

Pricing of Mutual Fund Units

NAV determines the purchase or redemption price of mutual fund units. Unlike stocks, mutual fund units are not traded throughout the day. When you invest in a mutual fund, your transaction is executed at the NAV declared after the market closes on the day of your purchase or redemption.

So, if you place a buy order at 1 PM, and the market closes at 3:30 PM, the NAV calculated at the end of that day will apply to your order.

Tracking Fund Performance

Many investors mistakenly think a higher NAV means the fund is expensive, and a lower NAV means it’s cheaper. That’s incorrect.

NAV is just the book value per unit. What matters more is how the NAV changes over time, which reflects the fund’s performance. For example:

- Fund A has an NAV of ₹10 and grows to ₹15 in a year — a 50% gain.

- Fund B has an NAV of ₹100 and grows to ₹110 in the same period — a 10% gain.

So, even though Fund A started with a lower NAV, it delivered a better return.

Reinvestment and Dividend Impact

In dividend plans, NAV decreases when a dividend is declared because the payout is made from the fund’s assets. So if a fund with an NAV of ₹20 declares a dividend of ₹2 per unit, the NAV may drop to ₹18 the next day.

In growth plans, no dividend is paid out, and the NAV reflects compounded growth of the portfolio over time.

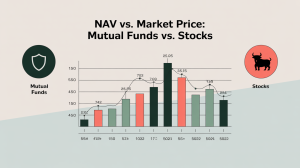

NAV vs. Market Price: Mutual Funds vs. Stocks

It’s important to note that mutual fund NAV is different from a stock’s market price.

- Stock prices are determined by market supply and demand and can change every second during trading hours.

- NAV, on the other hand, is calculated once daily and is based on the underlying asset value of the mutual fund.

So you can’t buy mutual fund units below or above NAV as you can with stocks — the price is fixed at NAV.

Does a Low NAV Mean a Better Buy?

A common myth is that low NAV mutual funds are better because they seem cheaper. But that’s not true. Mutual funds are not like stocks or real estate where a lower price implies a good bargain.

NAV simply reflects the value of the fund’s assets per unit. Two funds with identical portfolios but different NAVs (due to different launch dates or initial unit pricing) will deliver the same returns, assuming identical performance.

Focus on returns, risk profile, and portfolio quality—not the NAV alone.

Key Factors That Affect NAV

Several elements influence the NAV of a mutual fund:

- Market Movement: If the underlying securities rise or fall, the NAV adjusts accordingly.

- Fund Expenses: Management fees, operating costs, and other expenses are deducted from the assets and lower the NAV.

- Dividend Distributions: Payouts reduce the fund’s net assets, thus reducing NAV.

- Inflows and Redemptions: Though these don’t directly impact NAV, large inflows/outflows can affect the fund’s liquidity and strategy.

How to Use NAV in Mutual Fund Analysis

When evaluating mutual funds, use NAV as a reference point, not as the sole basis for investment. Here’s how you can use NAV wisely:

- Compare performance over time (1-year, 3-year, 5-year NAV growth).

- Track NAV volatility in different market conditions.

- Analyze NAV trends across similar funds in the same category.

- Combine NAV data with other metrics like expense ratio, Sharpe ratio, and fund manager track record.

Conclusion: NAV Is a Metric, Not a Value Judgment

In mutual fund investing, Net Asset Value (NAV) is a useful measure—but not a standalone indicator of a fund’s potential. A high NAV doesn’t make a fund expensive, and a low NAV doesn’t make it a bargain. What matters most is how well the fund’s NAV performs over time, which reflects how efficiently it manages its underlying investments.

So next time you’re evaluating mutual funds, look beyond just the NAV. Consider your financial goals, risk appetite, and investment horizon—and make NAV just one of several tools in your decision-making toolkit.