Why You Should Stay Invested During a Market Crash

Why You Should Stay Invested During a Market Crash

A market crash can feel like a financial earthquake—sudden, frightening, and unpredictable. When markets tumble, it’s tempting to pull out your investments and “cut your losses.” But here’s the truth:

Thank you for reading this post, don't forget to subscribe!Panic selling during a crash is often the biggest mistake an investor can make.

Staying invested—not running for the exit—is what separates long-term wealth creators from short-term speculators.

Let’s explore why holding your ground during a crash is often the smartest move.

What Is a Market Crash?

A market crash is a sharp and sudden decline in stock prices, usually triggered by economic events, geopolitical tensions, interest rate hikes, or unexpected global crises (like COVID-19 in 2020).

These events create panic, causing investors to sell in bulk—pushing prices even lower.

Why Investors Panic (But Shouldn’t)

❌ Emotion Over Logic

Fear of further loss often overrides sound financial judgment.

❌ Short-Term Focus

Many investors forget that markets recover over time—they focus on the next month, not the next 5 years.

❌ Herd Mentality

When everyone else is selling, it’s hard not to follow.

But historically, those who stayed invested came out ahead.

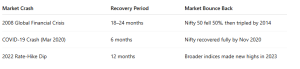

Historical Market Recoveries

Let’s look at real-world examples:

Lesson? Time in the market beats timing the market.

Why You Should Stay Invested

✅ 1. You Lock in Losses When You Sell

Selling during a dip turns paper losses into real losses. Staying invested gives your portfolio time to recover.

✅ 2. Crashes Create Buying Opportunities

High-quality stocks become undervalued. Smart investors use crashes to accumulate.

✅ 3. Market Cycles Are Natural

Bull and bear markets are part of the game. Long-term uptrend remains intact despite short-term volatility.

✅ 4. Power of Compounding Needs Time

The longer you stay invested, the more your returns compound. Crashes are just speed bumps—not roadblocks.

How to Stay Calm During a Crash

🔹 Stick to Your Asset Allocation

A balanced portfolio (equity + debt + gold) cushions you during downturns.

🔹 Avoid Checking Daily NAVs or Prices

Looking at losses every day only increases anxiety.

🔹 Use SIPs to Your Advantage

SIPs in a falling market buy more units at lower prices—boosting long-term gains.

🔹 Revisit Your Goals, Not Your Emotions

If your goal is 10 years away, a crash today doesn’t matter.

Real-Life Example: Ramesh, a 40-Year-Old SIP Investor

- In March 2020, Ramesh’s equity portfolio dropped 30%.

- Instead of stopping SIPs, he increased them.

- By March 2021, not only had he recovered his losses—his portfolio had grown 20% above the pre-crash level.

Why? He stayed calm and trusted the process.

⚠️ When Should You Reconsider Your Portfolio?

Staying invested doesn’t mean ignoring risks. You should review your portfolio if:

- Your risk profile or goals have changed

- Your portfolio is too equity-heavy for your age

- A stock or fund has fundamental issues, not just market-linked declines

Otherwise—sit tight and stay the course.

Conclusion

Market crashes are scary—but they’re also temporary. What matters most is your discipline and patience. Pulling out during a crash often means missing the rebound—and damaging your long-term returns.

So next time the market dips, don’t panic. Remember:

“Be fearful when others are greedy, and greedy when others are fearful.” – Warren Buffett

🚀 Need Help Navigating Market Volatility?

At Goodwill Wealth Management, we help investors build portfolios that can weather market storms—and come out stronger.

💬 Talk to our advisors today and ensure your investment journey stays on track.