Beyond Stocks and Bonds: Advanced Diversification Strategies for Investors

Beyond Stocks and Bonds: Advanced Diversification Strategies for Investors

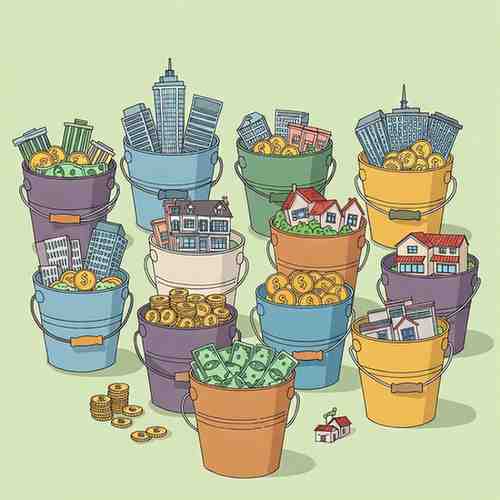

In the pursuit of robust financial health, investors often find themselves grappling with the complexities of portfolio management. While traditional assets like stocks and bonds form the bedrock of many investment strategies, relying solely on these instruments can expose portfolios to undue risk. This article delves into the necessity of moving beyond traditional assets, exploring advanced diversification strategies aimed at bolstering long-term returns and maintaining portfolio stability over time. We will examine how a well-structured diversification strategy, incorporating diverse asset classes and investment styles, can serve as a bulwark against market volatility, particularly relevant in the dynamic Indian financial landscape. The goal is to provide a comprehensive understanding of how to diversify stocks effectively and why diversification beyond stocks and bonds is essential.

The Limitations of Single Asset Type Investments

The Pitfalls of Concentration: The inherent risk associated with placing all capital in a single asset type is a fundamental principle of investment. Concentrating resources in one area, whether it be a specific stock or bond, leaves the portfolio vulnerable to market fluctuations and sector-specific downturns.

Why Diversification Beyond Stocks and Bonds Is Essential?

Indian investors are increasingly aware of the need to protect their investments from market vagaries.

Asset Class Diversification: Broadening the Horizon

Exploring Alternative Asset Classes: Moving beyond traditional assets entails diversifying across different asset classes. This approach involves incorporating assets such as real estate, commodities, and alternative investments.

We will examine the distinct characteristics of each asset class and how they can contribute to a balanced portfolio.

The Indian Market Context: The Indian market offers a range of asset class options, and this section will provide relevant context for local investors.

Sector-Based Diversification: Navigating Market Nuances

Within the realm of equity investments, Sector-Based Diversification plays a crucial role. This involves distributing investments across various sectors of the economy, such as technology, healthcare, and consumer goods.

By diversifying across sectors, investors 1 can mitigate the impact of sector-specific downturns and capitalize on growth opportunities in different areas.

Market Capitalisation Diversification: Balancing Growth and Stability

Market Capitalisation Diversification focuses on distributing equity investments across companies with varying market capitalizations, including large-cap, mid-cap, and small-cap stocks. Each category carries distinct risk and return profiles.

This strategy aims to balance growth potential with stability, ensuring a resilient portfolio.

Investment Style Diversification: Tailoring Strategies

Investment Style Diversification involves adopting a range of investment approaches, such as value investing, growth investing, and momentum investing.

This strategy recognizes that different market conditions may favor different investment styles. Incorporating a mix of styles can enhance portfolio resilience and capture diverse market opportunities.

Implementing a Well-Structured Diversification Strategy

Developing a well-structured diversification strategy requires careful consideration of individual risk tolerance, investment goals, and time horizon. Regular portfolio reviews and adjustments are essential to maintain alignment with evolving market conditions and personal circumstances.

This section will provide practical guidance on implementing and maintaining a diversified portfolio.

Long-Term Returns and Risk Mitigation

The primary objective of diversification is to enhance long-term returns while mitigating risk. By strategically allocating assets across different classes and sectors, investors can potentially achieve a more stable and predictable investment trajectory.

Conclusion

In the contemporary investment landscape, relying solely on traditional assets like stocks and bonds is insufficient. A comprehensive approach to portfolio management necessitates a well-structured diversification strategy that encompasses diverse asset classes, sectors, market capitalizations, and investment styles. By adopting such a strategy, investors can enhance their potential for long-term returns while mitigating the inherent risks associated with stock market investing. For the Indian investor, understanding and implementing these principles is pivotal to navigating the complexities of the financial markets and achieving sustained financial growth.

About GigaPro: GigaPro the mobile trading app prioritizes a user-friendly experience with a hassle-free login for both guest and authorized users, leading to a customizable dashboard that offers quick access to crucial information. This includes real-time market trends, important announcements, and comprehensive stock reports, all designed to keep users well-informed. The app also integrates advanced charting tools, potentially including TradingView, for in-depth analysis. By providing a wealth of easily accessible data and intuitive navigation, GigaPro aims to empower users to navigate the complexities of the market effectively. Download the app today to start your trading journey on your Android device: (Download GigaPro Mobile App) or on your Apple device: (Download GigaPro Mobile App).

Related Blogs:

Different Types of Commodities and Their Trading Characteristics

Beyond Stocks: Exploring the World of Commodities

Diversification Strategies: Combining Commodities and Equities

How to Use Sector Rotation to Diversify Your Portfolio

Commodity vs Equity Market: A Beginner’s Guide to Understanding the Differences

Understanding Asset Classes: A Beginner’s Guide to Stocks, Bonds, and Alternatives

Diversification Strategies: Why Spreading Your Risk Matters

How to Build an All-Weather Portfolio?

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.